Vol. 40 (Number 36) Year 2019. Page 18

Vol. 40 (Number 36) Year 2019. Page 18

GRYSHCHENKO Ivan M. 1; TARASENKO Iryna O. 2; TSYMBALENKO Nataliia V. 3; NEFEDOVA Tatiana M. 4 & TARASENKO Oleksii S. 5

Received:13/05/2019 • Approved: 12/10/2019 • Published 21/10/2019

ABSTRACT: The question of ensuring the efficiency of the functioning of Ukrainian universities, increasing their economic potential becomes a priority for the state, as the higher education system serves as a supplier of highly qualified personnel necessary for ensuring socio-economic progress. This article substantiates the necessity and proposes a sequence of construction of an economic and mathematical model for investment optimization in the development of Ukrainian universities, which has been approved at Kyiv National University of Technologies and Design. |

RESUMEN: La cuestión asociada con la garantía del funcionamiento efectivo de las universidades ucranianas, el aumento del potencial económico se convierte en una prioridad para el estado. El motivo es que el sistema de educación superior actúa como un proveedor de personal altamente calificado necesario para garantizar el progreso socioeconómico. El artículo argumenta la necesidad y sugiere una secuencia de construcción de un modelo económico-matemático para optimizar las inversiones en el desarrollo de las universidades ucranianas, aprobado en la Universidad Nacional de Tecnologías y Diseño de Kiev. |

In modern academic literature, the problems of economic and social aspects of the functioning of Ukrainian universities have been reflected (Bilovodska et al., 2017); the model of investment profitability in education based on the theory of human capital (Psacharopoulos & Patrinos, 2004); the analysis of individual factors in the formation of economic potential and the effectiveness of the activities of universities in Europe (Krpálek & Krpálková Krelová, 2016), defining strategic priorities for the development of education, taking into account the experience of the European Union countries (Duľová Spišáková et al., 2016). Ukrainian and foreign scientists who studied the economic potential of universities (hereinafter referred to as the EPU) in the context of resource scarcity, to the main directions of increasing their economic potential include the following: innovation development (Kasych, 2013) and the implementation of marketing technologies in the university management system (Bartosik-Purgat et al., 2017), the application of educational standards of European Union, taking into account Eurointegration and globalization processes in general (Bagmet & Liakhovets, 2017; Ishchenko-Padukova et al., 2017).

The academic papers of many Ukrainian and foreign scientists are devoted to the research of the economic potential essence, methods of its evaluation and management, among them are the following: Abankina I.V., Golovkova L.S., Goncharov V.M., Osovetskaya N.Ya., Savchenko M.V., Soloha D.V. (Golovkova, 2011; Abankina & Osovetskaya, s.f.; Goncharov et al., 2008). However, the problem of investing in the improvement of the EPU has not been widely reflected in the scientific works of Ukrainian scientists, since until recently the role of the universities investor of the country has been performed by the state, fully covering all their current needs and investing in development. In the course of the research, it has been found that when solving investment issues in the educational sphere, it is necessary to take into account the need to ensure, along with economic efficiency and social performance of education institutions. However, the most important problem for Ukraine at the present stage is the shortage of financial resources. This problem have become particularly acute in recent years in connection with the complication of financial and economic situation in Ukraine, which actualized the search for managerial decisions aimed at the rational use (optimization) of the limited financial resources of universities. Applied economic and mathematical models (hereinafter EMM), which have been used in various spheres of economic activity. Some theoretical, methodological and applied aspects of applying economic and mathematical modeling in solving administrative problems at universities are reflected in the works of such Ukrainian scientists as Dyadichev & Dodonova (s.f.), Karpiuk & Mamonova (s.f.). Psacharopoulos & Patrinos (2004), should be noted among the foreign authors who investigated the problem of investment in the educational sphere. However, as shown by the analysis of scientific literature, methodical and methodological solution to the problem of managing the economic potential of a separate university on the basis of available investment resources optimization has not been proposed either by Ukrainian or foreign science and practice.

This has led to the choice of this study purpose to achieve the aim the following methods have been used: semantic analysis (in studying and generalizing theoretical and methodological principles of the EPU management); statistical and economic analysis and expert assessments (in determining the significance of individual components, group and local indicators of the economic potential of university); economic-mathematical modeling (when building an EMM optimal distribution of available investment resources of university); logical generalization of the results (in the process of formulating conclusions based on the results of approbation of the proposed theoretical and methodological provisions).

The methodology of investment optimization into the development of the university’s economic potential, proposed in this article and tested at Kyiv National University of Technologies and Design, is based on the following theories, methods and methodologies: economic growth (Valero & Van Reenen, s.f.) and human development (Tsymbalenko, 2012), strategic management (Emelianov & Borisoglebskaya, 2007) and economic potential management of objects at different levels (Abankina & Osovetskaya, s.f.; Golovkova (ed.), 2011; Goncharov et al., 2008; Krpálek & Krpálková Krelová, 2016; Vladyka, s.f.), desirability theory (Harrington, 1965), methods of economic and mathematical modeling (Diadychev & Dodonova, s.f.; Ivashchuk (ed.), 2008; Karpiuk & Mamonova, s.f.; Kostenko & Rozhok, 2012). Based on the study of the mentioned scientific works, the following assumptions have been made: (1) the important prerequisite for economic and human development is the development of higher education; (2) the development of higher education requires, in particular, investments to enhance the economic potential of certain universities; (3) traditional methods of economic and mathematical modeling, as well as basic principles of the desirability theory, can be used to simulate the process of optimal distribution of investments between individual components of economic potential; (4) foreign experience of university development can be used to determine the main directions of investing in the development of Ukrainian universities. Given the fact that in Ukraine state-owned universities are non-profit organizations, the aim of optimization in the context of this study is to increase the level of the EPU based on the use of available resources (university's economic development fund) and to ensure balanced development of all areas of university's activities.

The category of "economic potential", as shown by the analysis of scientific works (Golovkova, 2011; Abankina & Osovetskaya, s.f.; Goncharov et al., 2008), is often defined as a set of resources and capabilities of the entity, which, with their efficient use and optimal interaction with the external environment, ensure goals achievement. Abankina and Osovetskaya (s.f.) consider economic potential to be one of the main factors to be taken into account when deciding whether to change the status of a particular university from a budget institution to an autonomous institution. By analogy with the definitions of economic potential as the cumulative capacity of enterprises (organizations, industries) to produce certain goods, conduct research and provide services, the researchers proposed the definition of the EPU as a set of "internal resources and external conditions, the availability of which provides university with the ability to provide services of the established quality level into a certain extent (Abankina & Osovetskaya, s.f.). Special significance of potential offered by I.V. Abankina and N.Ya. Osovetskaya is explained by the fact that the economic potential allows predicting the stability of any organization to change the operating conditions. In addition, the level of economic potential is an indicator of university's readiness to operate in conditions of greater management and economic independence. Therefore, this indicator should be considered to be one of the most important when deciding to grant the university the status of an autonomous institution, especially considering the reduction of budget funding. The comprehensive evaluation of the economic potential of Russian universities, which results have been reflected in the article (Abankina & Osovetskaya, s.f.), envisaged an analysis of their internal potential and evaluation of the external environment. The internal potential of universities has been assessed by the components of material and technical base, human potential, the contingent of students studying in different programs, the volume of financial resources (budget and extra budgetary). The assessment of the environmental impact on the EPU involved the analysis of information on their location development, rate of unemployment, income level and economic specialization of the regions.

The issues of developing the innovation potential of universities, which is considered to be a mechanism for influencing not only the development of education and science in the country but also the economy and social sphere, have also been reflected in scientific literature (Vladyka, s.f.). Thus, the researchers determine the innovative potential as a system of interacting innovative resources of the university education sector necessary for the implementation of innovation activities, taking into account their limited and possible influence (negative or positive) on the final result of their activity (Emelianov & Borisoglebskaya, 2007; Yrinen & Lt; Petola, 2006; Kirby, 2006). At the same time, the innovation potential is considered to be a factor in the realization of the competitive advantages of the universities of the country, their investment-innovation attractiveness (Vladyka, s.f.). At the same time, innovative resources include intellectual, material, financial, informational and other types that are used to provide an innovation process at universities.

Thus, according to the study results, the most significant features of the EPU as an economic category have been identified: (1) the availability of the resource component, which is the basis of the entity's potential; (2) availability of a mechanism to control the use of resources (management); (3) the need to take into account the influence of the environment and, in this regard, assess the ability of the entity to interact with contractors; (4) the dependence of economic performance on the level of economic potential.

Foreign scientists in their studies (Anna Valero & John Van Reenen, 2019; Anna Valero & John Van Reenen, sf; Gennaioli et al ., 2014) have considered the potential of universities from the standpoint of ensuring economic growth based on the growth of human capital they create. Scientists note "Empirical macroeconomic research has generally found that human capital (typically measured by years of schooling) is important for a country's development and growth. It is difficult, though, to prove the link in the country level, as there are many factors that we need to control. At the subnational level, human capital is important for regional GDP per capita in cross section and also for growth» (Gennaioli et al., 2014). At the subnational level, where you can hold unobserved country, specific factors are constant.

Thus, the state and efficiency of using economic potential determines the possibility of ensuring the university development. The structure of economic potential, which requires the search for new approaches to its improvement, is important in this case. In view of this, the current task is to assess the existing capacity and resources of university to achieve a more effective use and distribution.

When solving the problem of financing the system of higher education, the issue of extreme urgency is the substantiation of effective models of investment in the development of universities that are adequate to the current socio-economic situation in Ukraine. The main sources of investment support for higher education are the funds of the state and local budgets; funds of legal entities and individuals, public organizations and funds, including charitable contributions and donations; funds from extra services provision by education institutions; grants; loans for university development and education; funds from the economic activity of universities, regulated by the state.

Taking into account the above, the importance of ensuring the economic efficiency of university is growing, which, in the conditions of limited financial resources, necessitates the search for optimal ways of their use in the process of investing in the raise of level of the individual components of the EPU. This can be solved by building an appropriate EMM, which will provide the opportunity to choose the best investment option in accordance with the accepted criteria and existing restrictions. The analysis of scientific works (Kazarezov & Tsyplytskaya, 2009; Ivashchuk, 2008; Polodin, 2011; Dyadichev & Dodonova, s.f.; Karpiuk & Mamonova, s.f.) showed that, despite the widespread use of optimization economic and mathematical models in substantiating investment decisions, the question of optimizing the distribution of investments in order to increase the economic potential of the university has not been reflected in the scientific literature.

Theoretical, methodological and applied aspects of the economic mathematical modeling application in solving administrative tasks at universities have been reflected in the works of Ukrainian scientists, that have demonstrated the possibility of using economic and mathematical models in the process of optimizing a particular aspect of university's activities, namely, the cost of educational services. The objective function of the economic mathematical model proposed in the work of Kostenko & Rozhok (2012), is to minimize the cost of training one student. The main limitations of this function are defined as licensed student training, the area of training facilities, equipment and implements, payroll fund of scientific and pedagogical, administrative, managerial, auxiliary and service staff. The economic mathematical model of the socio-economic potential formation of university, proposed by M.V. Artyuhina (2009), deserves attention. This model is aimed at achieving a harmonious relationship between resources and their increase in the direction of the reference value, which involves maximizing the university's revenues, optimizing expenditures for maintaining and increasing its socioeconomic potential, and ensuring an efficient distribution of income (Artyukhina, 2009).

George Psacharopoulos and Harry Anthony Patrinos (2004), who conducted quasi-experimental studies of education economics, concluded that by level of efficiency investment in education was close to physical capital investment. Scientists proceeded from the fact that in industrialized countries, profits from human and physical capital, as a rule, have the same margin. At the same time, scientists note that the conclusions about the profitability of investment in education vary according to the level of research: microeconomic studies indicate that there are significant returns on investment in education, while the results obtained at the macroeconomic level are not so consistent and unambiguous. Therefore, additional research is needed on the social benefits of learning using a quasi-experimental study that can be used to create programs to promote reform and increase investment (Psacharopoulos & Patrinos, 2004).

In the countries of the post-socialist space, where the organization of the educational sphere has many common features, the study relevance of the problems of the EPU is also increasing because of the conditions and factors. These include insufficient level of budget financing, which significantly limits the financial capabilities of university; the intensification of competition in the market of educational services as a result of an increase in the number of commercial education institutions within the country, as well as increased competition with foreign universities; deterioration of the demographic situation; high dynamics of factors that determine the order of functioning education institutions and cause resources diversion of universities to develop adaptation mechanisms instead of focusing on educational goals (Abankina & Osovetskaya, s.f .; Tsymbalenko et al., 2019).

The concept of economic potential, which is reflected in the works of Ukrainian and Russian scientists (Golovkova, 2011; Abankina & Osovetskaya, s.f .; Goncharov et al., 2008), in this study is refined from the standpoint of its relevance to the goals and objectives of the Ukrainian universities. Thus, taking into account the peculiarities of the educational environment of Ukraine, the EPU is defined as an integral characteristic of its ability to achieve strategic goals in conditions of dynamic changes in the external environment, which is ensured by the ability of the management system to effectively use available resources. The high level of the economic potential of university is the basis of its financial stability and the ability to function autonomously. The main components of the economic potential of university are grouped as follows: 1. Resource component with the identification of groups of indicators: 1.1.Human capital development; 1.2. Financial resources; 1.3. Material-technical base; 1.4. Research base and intellectual resources; 1.5. Marketing resources and information and communication technologies; 2. Management component, which characterizes the level of the EPO in groups of indicators: 2.1. Organization of educational process, research and innovation activities; 2.2. Financial management and investment activity; 2.3. Human capital management and motivation system; 2.4. Social responsibility and interaction with stakeholders.

For the analysis of the economic potential of university, a methodological approach developed by V. Verba and I. Novikova (Verba & Novikova, 2003) has been adapted. This allowed developing the following sequence of analysis of the economic potential of university in this study context.

1. Evaluating the level of the EPU on the components, which includes: (1) determining the main components of the EPU and establishing a system of local indicators for estimating each component (analysis of the resource and management components of the EPU involves their elaboration on the factors and the construction of the corresponding indicators of each factor of the local indicators system); (2) determining the base values and the priority level of local indicators of the EPU in accordance with the criteria of the desirability function of E. Harrington (1965); (3) estimating the correspondence of the actual level of each local index to the criteria of the Harrington desirability function and the determining the group indices based on them (using the additive convolution method). An example of calculating local and group indicators "Material and technical base" according to the data of Kyiv National University of Technologies and Design (hereinafter - KNUTD) is given in the Table 1; (4) calculating aggregate indicators of resource and managerial components in a similar procedure, taking into account their importance; (5) estimating the integral index of the EPU taking into account the level of management and resource components. An example of the calculating group and integral indicators of the economic potential assessment of KNUTD is given in Table 2.

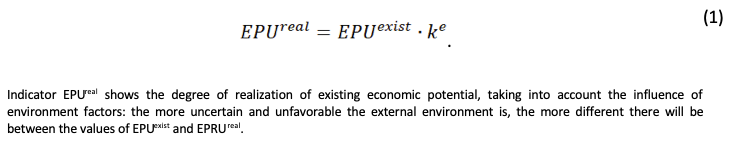

2. Evaluating the level of the EPU implementation, taking into account the impact on the university activities of the environment factors, included the analysis of existing and potential external opportunities and threats in order to assess their impact on the level of the EPU implementation. To solve this problem it has been suggested to use the coefficient of favorability (unfavorability) of the external environment, the method of determination of which is given in (Tsymbalenko, 2012). In general, this indicator will determine the relationship between the threats, opportunities and uncertainty of the state of the environment in relation to the level of implementation of the EPU at a specific time point. The value of the integral indicator of the implementation of the EPU taking into account the influence of environmental factors can be represented by the dependence:

Table 1

Estimation of individual and group indicators performance according to the

group "Material and technical base" using the function of Harrington (1965)

The actual value of the local indicator (хі) |

The best (excellent) value of the local indicator |

Acceptable (satisfactory) local indicator value |

Coefficients |

Limit values of local indicators (yі) |

The level of the local indicator in accordance with the function of E. Harrington (dі) |

Strength of the local indicator |

Values of local indicators taking into account their strength |

||

а0 |

а1 |

||||||||

2018 |

2018 |

2018 |

|||||||

Local indicators |

|||||||||

The level of capital investment in the main means of innovation, social or research activities |

|||||||||

0,86 |

1,0 |

0,6 |

-2,30 |

3,83 |

0,88 |

0,69 |

0,238 |

0,164 |

|

The intensity of the university's basic assets renewal |

|||||||||

0,74 |

0,8 |

0,6 |

-4,59 |

7,65 |

1,07 |

0,71 |

0,224 |

0,159 |

|

The share of new equipment in its total quantity |

|||||||||

0,64 |

0,7 |

0,5 |

-3,83 |

7,65 |

0,84 |

0,71 |

0,163 |

0,116 |

|

The share of implemented new technological processes (non-waste and resource-saving) in the total number of new technological (service) processes |

|||||||||

0,88 |

0,9 |

0,6 |

-3,06 |

5,10 |

1,33 |

0,79 |

0,176 |

0,139 |

|

The share of created (purchased) new technologies in the total number of implemented in educational (scientific) activities |

|||||||||

0,92 |

1,0 |

0,7 |

-3,57 |

5,10 |

1,12 |

0,72 |

0,199 |

0,143 |

|

Group indicator of economic potential of KNUTD for the group "Material and technical base" |

0,721 |

||||||||

Interpretation of the group indicator "Material and technical base" according to the desirability scale of E. Harrington |

average level (good) |

||||||||

Based on the adapted to the subject area of the research methodology (Tarasenko, 2010), there has been done an assessment of the impact of environmental factors on the development of Ukrainian universities in 2018. In general, as shown by the analysis, the level of threats both in terms of their number and intensity of influence on the development of the higher education system in Ukraine exceeds the level of available opportunities.

Table 2

Estimation of the group and integral indicators

of economic potential of KNUTD in 2018

Indicators |

Strength |

Indicators value (Ij) |

Indicators value based on their strength |

|

Resource component of economic potential |

||||

Group indicators |

|

0,170 |

0,786 |

0,134 |

|

0,165 |

0,704 |

0,116 |

|

|

0,030 |

0,721 |

0,022 |

|

|

0,090 |

0,794 |

0,071 |

|

|

0,045 |

0,667 |

0,030 |

|

Total |

0,5 |

- |

0,373 |

|

Management component |

||||

Group indicators |

2.1. Organization of educational process, research and innovation activities |

0,142 |

0,779 |

0,111 |

2.2. Financial management and investment management |

0,050 |

0,772 |

0,039 |

|

2.3. Human capital management and motivation system |

0,108 |

0,685 |

0,074 |

|

2.4. Social responsibility and interaction with stakeholders |

0,200 |

0,81 |

0,162 |

|

Total |

0,5 |

- |

0,385 |

|

Integral indicator of economic potential |

0,758 |

|||

This is confirmed by a certain index of the environment (ke= 0,779), which indicates the prevalence of threats over opportunities (in the balance of threats and opportunities it was assumed that ke=1,000, with the predominance of opportunities over threats - ke> 1,000). The obtained value of this indicator shows that at present the state of the environment is unfavorable to the development of university education in Ukraine and allows us to conclude that there is a need to accelerate the reform of the educational sphere and strengthen the role of the state in this process.

The main stages of the EMM investments optimization in the EPU are shown in Fig. 1.

1.1. The amount of cash that is available at university and can be used to invest in raising economic potential - the fund for economic development (Fed). It is assumed that KNUTD economic development fund is formed at the expense of a part of the special fund that was not used to cover current expenses of the university in terms of activities.

Figure 1

Stages of an economic-mathematical model scheme for optimizing the

volume of investments in increasing the economic potential of university

1.2. The time resource is proposed to be determined depending on the level of the indicator, which is planned to increase as a result of the implementation of a specific measure. Therefore, the increase of local indicators refers to the level of operational management (up to one year); group - to tactical (from 1 to 3 years); integral - to the level of strategic management of university development (more than 3 years).

1.3. The expected effects of investing in university development are proposed to be evaluated according to the criteria of their economic and social effectiveness. According to the authors, in addition to the economic efficiency of investments in increasing the economic potential of university, social efficiency is no less important criterion for their evaluation. The main manifestation of social performance is university’s positive impact on the society development through the following factors: improving the quality of education; providing the economy with highly skilled specialists; assisting in raising the qualification level of academic staff; contributing to the development of science and technology; growing labor productivity and, on this basis, ensuring GDP growth.

The expected effect of optimizing investments in increasing KNUTD economic potential is to ensure the rational use of Fed funds and balanced development of the university in all major areas.

One of the most significant constraints in constructing the proposed EMM is the size of the economic development fund (Fed), whose size at a particular time depends on the university financial capabilities. The formalization of this limitation has the form of inequality:

where n is a number of possible investment directions.

The main investment directions have been proposed to determine in accordance with the level of components of the economic potential of university (based on the results of the evaluation of the group indicators for each component), namely, the development of the resource component (according to the group indicators: material and technical base, human capital, financial resources, research base and intellectual resources; marketing resources and information and communication technologies); management component (according to the group indicators: organization of educational process, research and innovation activity, financial management and investment activity, human capital management and system of motivation, social responsibility and interaction with stakeholders).

The proportions of the distribution of the economic development fund (αjand βj) according to the investment directions are proposed to be determined according to the importance of the components of the economic potential of university (and within each component - the corresponding group indicators for each investment direction) determined using the expert estimation method, taking into account their standard deviations.

The influence of environmental factors in the development of EMM investments in increasing the EPU has been proposed to evaluate using the coefficient of favorability (neutrality or unfavorability) of the environment, which is determined on the basis of the analysis of the influence of the environment factors (Tarasenko, 2010). This, taking into account the financial capabilities of the university at a specific time, will allow us to determine the potential size of the economic development fund. Thus, in the unfavorable state of the external environment (ke) it is recommended to form a fund for economic development on the residual principle, and with favorable – the formation of the fund may be based on the target principle.

The objective function of the economic-mathematical model of investment optimization in the improvement of the EPU is based on the relationship between the actual levels of indicators to improve investment and the expected effects of these investments on the results of the evaluation of economic potential. With the adaptation of main provisions of the methodological approach to investing in the development of human capital described by Tsymbalenko (2012) towards the subject area of investment in the EPU, the following assumptions were made when constructing the target function: (1) the maximum possible value of the j-th of the group indicator (Ij)will be „1” (Ij=1); (2) the difference between „1” and the actual value of the j-th of the group indicator is a characteristic of the university's potential ability to increase the level of the corresponding (j-th) group indicator. This value is directly related to the economic efficiency of investments in a particular direction, which is reflected in the target function of investment in increasing the economic potential of university (see Figure 1). In addition, when constructing the target function, the importance of the group indicators of the economic potential of university (γj) is taken into account in order to ensure priority of investment directions. The actual levels of the group economic indicators of KNUTD (Ij)are determined by combining separate indicators of the level of economic potential using the criteria of the function of E. Harrington (1965).

The assessment of the investments economic efficiency is proposed to be carried out according to the principles of rational economic behavior, which involves investing in those areas in which the received income will exceed the amount of expended resources. It should be noted that the cost of raising the level of the EPU should also take into account the lost gains (income foregone) that could be obtained in an alternative way of using the invested resources. In order to evaluate the investments economic efficiency in improving the EPU, indicators of net present value and internal rate of return of investments can be used; as well as added value of the university created as a result of investment; return on investment; payback period of investments.

The decision to choose the investment direction and structure in improving the EPU is based on the results of the investment optimization evaluation. The use of EMM to optimize the volume of investments in increasing the EPU is a tool of due validity of management decisions, which is ensured by its adaptability to changes in internal and external factors. Retaining existing positions and building economic potential will require from Ukrainian universities to search for additional sources of investment resources and develop an appropriate economic strategy. The use of the proposed model for optimization of investments necessitates the change of the initial parameters in accordance with the changes in the indicators of the EPU, the index of the environment, and the value of KNUTD economic development fund.

The proposed economic-mathematical model was used in solving the problem of investment optimization in increasing KNUTD economic potential. As demonstrated by the experience of implementing innovations in the educational, scientific and economic activities of Kyiv National University of Technologies and Design, the main factors in ensuring the economic efficiency of the university's activities are: improving the university management system; rational use of energy carriers and other types of resources; improvement of the content of educational programs in accordance with the requirements of the labor market; raising the qualification level and motivation of academic staff; improvement of organization of educational processes; introduction of marketing innovations; establishing effective communications with different categories of stakeholders. However, in some cases, the decision to allocate financial resources of the special fund for development (investment) has been made intuitively, which led to the inefficient use of limited financial resources and, consequently, failure to achieve the goals.

The application of the proposed EMM allowed determining the optimal structure of investment in the main directions of KNUTD development (Table 3). The calculation of the parameters of the investment optimization model in the university development, conducted on the basis of its evaluation in 2018, indicates the feasibility of investing in all major areas, which are presented in Table 3. As can be seen from the data of Table 3 the most priority was determined to be the investment direction in raising the level of social responsibility and the interactions effectiveness with stakeholders – 24,6 %. This means that in current operating conditions, the priority task for KNUTD is to ensure effective interaction with key groups of stakeholders, including entrants and students, employers, business partners and others, which involves further improving the methods of managing these processes. In addition, according to the optimization results, the distribution of investment resources accumulated in the university's economic development fund has been obtained. It involves investing in such main areas as human capital development – 21,6 %; a volume increase of financial resources – 21,1 %; improvement of educational process, research and innovation activity – 18,75 %; improvement of human capital management and system of motivation – 9,15 %; research base development and ensuring the growth of intellectual resources – 4,4 %; financial management improvement and investment activity management – 0,4.

Table 3

The directions of university development investment (using KNUTD

as an example) according to the results of EMM investments optimization

Number of the investment direction |

Level of the corresponding group indicator (Ij) |

Potential opportunity to increase the level of the corresponding group of indicators (1-Ij) |

Strength of jth aggregate indicator of EPU (γj) |

Restriction of investments in the direction, share of Fed (aj-bj), % |

Distribution of investment resources (Fed) in directions |

|

% |

thousand UAH |

|||||

Resource component |

||||||

1.1 |

0,786 |

0,214 |

0,170 |

12,4-21,6 |

21,60 |

1436,40 |

1.2 |

0,704 |

0,296 |

0,165 |

11,9-21,1 |

21,10 |

1403,15 |

1.3 |

0,721 |

0,279 |

0,030 |

0-7,6 |

0,00 |

0,00 |

1.4 |

0,794 |

0,206 |

0,090 |

4,4-13,6 |

4,40 |

292,60 |

1.5 |

0,667 |

0,333 |

0,045 |

0-9,1 |

0,00 |

0,00 |

Organizational management component |

||||||

2.1 |

0,779 |

0,221 |

0,142 |

9,55-18,75 |

18,75 |

1246,87 |

2.2 |

0,772 |

0,228 |

0,050 |

0,4-9,6 |

0,40 |

26,60 |

2.3 |

0,685 |

0,315 |

0,108 |

6,25-15,45 |

9,15 |

608,48 |

2.4 |

0,810 |

0,190 |

0,200 |

15,4-24,6 |

24,60 |

1635,90 |

KNUTD economic development fund subject to distribution |

100,00 |

6650,00 |

||||

It should be noted that such a division corresponds to the situation prevailing at the university and has an objective background. Thus, the need to ensure effective interaction with stakeholders, adherence to the principles of social responsibility in modern conditions is one of the main areas for additional competitive advantages of the university and ensuring its level of economic potential. The further investment direction at the university remains the further development of KNUTD human capital. The increased attention to the issues of organizing the educational process, research and innovation activity is explained by the fact that the reform of the Ukrainian education system and the strengthening of globalization processes, which manifests itself in the intensification of competition in the market of educational services, cause the need to strengthen competitive positions on the basis of improving the quality of educational services, performance research work.

Since the crisis in economic, political and social spheres limits the state's ability to finance the activities of Ukrainian universities, the overcoming of existing threats requires from the leadership of Ukrainian universities to seek sources and justify the use of available investment resources in order to increase the economic efficiency of investments. The indicated tasks in this research have been proposed to be solved by constructing an economical-mathematical model of optimal distribution of investment resources, which should provide an increase in the economic potential of university through the most effective choice of directions and scope of their use. According to the results of the research, the feasibility of investing in increasing KNUTD economic potential based on determining the optimal directions and investment volumes has been substantiated.

It has been concluded that investing in increasing the economic potential of university contributes to the improvement of its individual elements due to the possibility of implementing measures. They are aimed at effective interaction with stakeholders, raising the level of human capital through the implementation of training and development programs for personnel; financing of innovation activity, educational, scientific and social programs; informatization of educational process, scientific, scientific and technical activity and management; alignment with the strategic priorities of the organizational structure, technology and management system of university. Solving the problem of optimal allocation of available investment resources with the use of the proposed EMM will contribute to the growth of the economic potential of university, its financial stability and independence, and the ability to operate autonomously in the future.

Abankina. I.V.. & Osovetskaya. N.Ya. (s.f.) Ekonomicheskiy potentsial VUZA kak faktor prinyatiy resheniya o perevode v avtonomnoye uchrezhdeniye [Economic potential of an institution of higher education as a factor in the decision to transfer to an autonomous institution]. Retrieved from source: https://cyberleninka.ru/article/v/ekonomicheskiy-potentsial-vuza-kak-faktor-prinyatiya-resheniya-o-perevode-v-avtonomnoe-uchrezhdenie. (in Russian)

Bagmet, M., & Liakhovets, O. (2017). Towards the European Union’s Education Standards: Expectations of the Ukrainians. Economics & Sociology, 10, 2, 191-206.

Bartosik-Purgat, M., Filimon, N., & Kiygi-Calli, M. (2017). Social media and higher education – an international perspective. Economics & Sociology, 10, 1, 181-191.

Bilovodska, O., Golysheva, I, Gryshchenko, O., & Strunz, H. (2017). Theoretical and practical fundamentals of scientific and educational projects: a case of Ukraine. Journal of International Studies, 10, 2, 119-128.

Diadychev, V.V., & Dodonova, V.V. (s.f.). Modeliuvannia protsesu otsinky yakosti osvity zakladu vyshchoi osvity za dopomohoiu avtomatyzovanoi systemy keruvannia [Modeling the process of assessing the quality of higher education through an automated control system]. Retrieved from source: http://dspace.snu.edu.ua:8080/jspui/bitstream/123456789/1331/1/12dvvsvo.pdf . (in Ukrainian)

Duľová Spišáková, E., Gontkovičová, B., & Hajduová, Z. (2016). Education from the Perspective of the Europe 2020 Strategy: the Case of Southern Countries of the European Union. Economics & Sociology, 9, 2, 266-278.

Emelianov. S.G.. & Borisoglebskaya. L.N. (2007). Ekonomicheskiy mekhanizm strategicheskogo upravleniya razvitiyem vuza [Economic mechanism of strategic management of university development]: monografiya. Moskva: Vysshaya shkola. (in Russian)

Gennaioli, N., La Porta, R., Lopez de Silanes, F., Shleifer, A. (2014). Growth in Regions. Journal of Economic Growth, 19, 259-309.

Golovkova, L.S. (ed.), (2011). Orhanizatsiino-ekonomichni zasady rozvytku potentsialu sotsialno-ekonomichnykh system [Organizational and economic principles of the potential development of socio-economic systems]: monohrafiia. Zaporizhzhia: KPU. (in Ukrainian)

Goncharov, V.M., Savchenko, M.V., Solokha, D.V. et al. (2008). Orhanizatsiia upravlinnia ekonomichnym potentsialom promyslovykh pidpryiemstv [Organization of economic potential management of industrial enterprises]: monohrafiia. Donetsk: SPD Kupriianov V.S. (in Ukrainian)

Ishchenko-Padukova, O., Kazachanskaya, E., Movchan, I., & Nawrot, L. (2017). Economy of education: National and global aspects. Journal of International Studies, 10, 4, 246-258.

Ivashchuk, O.T. (ed.), (2008). Ekonomiko-matematychne modeliuvannia [Economic-mathematical modeling]: Navchalnyi posibnyk. Ternopil: TNEU «Ekonomichna dumka». (in Ukrainian)

Harrington, E.C. (1965). The Desirability Function. Industrial Quality Control, April, 494–498.

Karpiuk, O.A., & Mamonova, H.V. (s.f.). Ekonomiko-matematychne modeliuvannia rozvytku rynku osvitnikh posluh rehionu [Economic-mathematical modeling of the development of the regional educational services market]. Retrieved from source: http://eztuir.ztu.edu.ua/1271/1/20.pdf . (in Ukrainian)

Kasych, A.O. (2013). Dosvid formuvannia natsionalnykh innovatsiinykh system v krainakh, shcho rozvyvaiutsia [The experience of the formation of national innovation systems in developing countries]. Aktualni problemy ekonomiky, 5 (143), 46–49. (in Ukrainian)

Kirby, D.A. (2006). Creating Entepreneurial Univercities in the UK: Applying Entepreneurial Theory to Practice. Journal of Technology Transfer, 31. Р. 599-603.

Kostenko, H.I., & Rozhok, O.A. (2012). Modeliuvannia sobivartosti osvitnoi posluhy zakladu vyshchoi osvity [Simulation of the cost of educational services for institutions of higher education]. Aktualni problemy ekonomiky, 12 (138), 190-195. (in Ukrainian)

Krpálek, P., & Krpálková Krelová, K. (2016). Possibilities for Developing Business Potential in Economic Education. Examples of Implementation in Slovakia and the Czech Republic. Economics & Sociology, 9, 4, 119-133.

Psacharopoulos, G., & Patrinos, H.A. (2004). Returns to investment in education: a further update. Education Economics, 12, 2, 111-134.

Tarasenko, I.O. (2010). Stalyi rozvytok pidpryiemstv lehkoi promyslovosti: teoriia, metodolohiia, praktyka [Sustainable development of light industry]: Monohrafiia. K.: KNUTD. (in Ukrainian)

Tsymbalenko, N.V., Tarasenko, I.O., & Bielialov, T.E. (2019). The impact of demographic processes on forming student body in Ukraine. Revista Espacios, 40, 2. Retrieved 22 April, 2019, from source: http://www.revistaespacios.com/a19v40n12/19401208.html.

Tsymbalenko, N.V. (2012). Investuvannia rozvytku liudskoho kapitalu (optymizatsiina model). Finansy pidpryiemstv: problemy ta perspektyvy [Investing in human capital development (optimization model)]. Kyiv: TOV «PanTot», 63-77. (in Ukrainian)

Valero, А., & Van Reenen, J. (2019). The economic impact of universities: Evidence from across the globe. Economics of Education Review, 68 (2019), 53–67. Retrieved from source: https://reader.elsevier.com/reader/sd/pii/S0272775718300414?token=5E7F8BC0658612D457177CF0F32970C6E067B9 78885AD221E1CF5C70B27BC6855CB9A1AE17A4A096F2122FC8C8C73FC7

Valero, A., & Van Reenen, J. (s.f.). How universities boost economic growth. VoxEU.org – CEPR’s policy portal. Retrieved 10 November, 2016, from source: http://voxeu.org/article/how-universities-boost-economic-growth

Verba, V.A., & Novikova, I.V. (2003). Metodychni rekomendatsii z otsinky innovatsiinoho potentsialu pidpryiemstva [Methodical recommendations for assessing the innovation potential of the enterprise]. Problemy nauky, 3, 22–31. (in Ukrainian)

Vladyka. M.V. (s.f.). Innovatsionnyy potentsial vuzov kak faktor konkurentnosti ekonomicheskogo razvitiya [Innovation potential of universities as a factor of economic development competitiveness]. Retrieved from source: https://cyberleninka.ru/article/n/innovatsionnyy-potentsial-vuzov-kak-faktor-konkurentnosti-ekonomicheskogo-razvitiya . (in Russian)

Yrinen, M.H., & Petola, U. (2006). The problems of market-oriented Univercity. Higher Education, 52, 251-281.

1. Kyiv National University of Technologies and Design, Ukraine, e-mail: hrischenko@gmail.com

2. Department of Finance and Financial and Economic Security, Kyiv National University of Technologies and Design, Ukraine, e-mail: irataras@ukr.net

3. Department of Finance and Financial and Economic Security, Kyiv National University of Technologies and Design, Ukraine, e-mail: natashats@ukr.net

4. Kyiv National University of Technologies and Design, Ukraine, e-mail: nefedova77@ukr.net

5. Department of Management, Kyiv National University of Technologies and Design, Ukraine, e-mail: tarasenko@jungheinrich.ua