Vol. 40 (Number 28) Year 2019. Page 24

ALMODOVAR-GONZÁLEZ, Manuel 1; SÁNCHEZ-ESCOBEDO, Mari C. 2 & FERNÁNDEZ-PORTILLO, Antonio 3

Received: 22/05/2019 • Approved: 15/08/2019 • Published 26/08/2019

6. Limitations and directions for future research

ABSTRACT: This study examine the relationship between a set of demographic variables, entrepreneurial activity, and economic growth. For there was employed a classification of economies in terms of the impact of entrepreneurship on economic growth. The World Bank´s Indicators, and Global Entrepreneurship Monitor, provided three dimensions of demographics, economic development, and entrepreneurship. Results show that the relationships between demographic factors, entrepreneurship, and economic growth depend on the stage of a country’s economic cycle. |

RESUMEN: Este trabajo examina la relación entre un conjunto de variables demográficas, de actividad emprendedora y crecimiento económico. Para ello se empleó una clasificación de economías en términos del impacto del emprendimiento en el crecimiento económico. Los Indicadores del Banco Mundial y el Observatorio Global de emprendimiento proporcionaron los datos para medir la demografía, el desarrollo económico y la actividad emprendedora. Los resultados muestran que las relaciones entre la demografía, el espíritu empresarial y el crecimiento económico dependen del ciclo económico del país. |

Scholars have consistently acknowledged the influence of entrepreneurship on economic growth but have yet to deepen their understanding of this relationship, or the channels or factors through which the relationship occurs. Furthermore, many governments are investing large sums of money in policies to foster entrepreneurship without fully appreciating this relationship (Audrestsch, 2009; Almodóvar, 2018). This lack of understanding in both academia and politics may prevent politicians from devising policies that have a meaningful impact on their nation’s macroeconomic situation. It is therefore becoming increasingly important to gain an understanding of the role that entrepreneurship plays in countries’ economic growth (Minniti, 2012).

A review of recent literature reveals that large enterprises are not the only economic actors to play a key role in economic growth. Small and medium enterprises also drive economic efficiency. Many researchers have therefore assumed that entrepreneurship results only in positive outcomes for ecopnomic growth. Some scholars have denied the possibility that such activity may actually result in so-called destructive entrepreneurship (Desai et al. 2013), even though in certain countries the institutional framework is such that profit-making opportunities may actually stem from socially destructive behaviors (Baumol 1990; Henrekson and Sanandaji, 2011).

A further problem that arises in research on entrepreneurship is that, although extensive studies have taken place in Western countries (Acs and Szerb 2007; Bruton et al. 2008), research has been limited in developing and emerging economies (Naudé 2011). Hence, studies in this group of economies are needed to determine the extent to which the impact of entrepreneurship on economic growth depends on a country’s stage of development (Carree et al., 2002; van Stel et al. 2005; Wennekers et al., 2005).

By adopting a range of approaches, scholars have demonstrated the impact of demographics on entrepreneurship (Arenius and Minitti, 2005; Wennekers et al., 2005; Bosma et al., 2008; Bosma and Schutjens, 2011). For this study, we opted for just one of these approaches. Specifically, we focused on three demographic concepts: population density, population growth, and age. All three of these dimensions are generally associated with entrepreneurial activity. Whereas environments with high population densities are propitious to business creation (Audretsch and Keilbach, 2004; Arenius and De Clercq, 2005; Bosma and Schutjens, 2011), societies with high population growth have more entrepreneurs (Armington and Acs, 2002; Wennekers et al., 2005; Bosma et al., 2008). Also, several authors have stated that the probability of engaging in an entrepreneurial undertaking decreases with age (Levesque and Minniti, 2006; Mueller 2006; Vaillant and Lafuente, 2007).

Given the aforementioned research gaps associated with the study of entrepreneurship and the importance of demographics in explaining entrepreneurial activity, our study was designed to explore the relationship between demographics and entrepreneurship. We also examined the impact of these variables on economic growth in both developed and emerging economies. To achieve these aims, we defined a statistical model that selected only the demographic variables that simultaneously have relationships with entrepreneurship and development. The analysis was performed for developing economies and again for developed economies.

Including economic growth and developing countries in our analysis of the relationship between demographics and entrepreneurship has yielded a new research perspective; namely, that the link between demographics, entrepreneurship, and economic growth varies in relation to an economy’s stage of development. Our results show that, in developed countries, there exists a negative relationship between the proportion of economically inactive adults in the population, and the volume of entrepreneurial activity and level of economic growth. In developing economies, however, a young, rapidly growing population is related to lower growth rates and greater levels of entrepreneurship.

This section has introduced the aims and approach of this research. The following section describes the theoretical framework. The subsequent sections present the study design, results, discussion, and conclusions. The final section draws together the limitations of the study and directions for future research.

Many authors have presented entrepreneurial activity as the main source of economic growth (Sobel, 2008; Nissan et al., 2011). A different approach that links entrepreneurship to economic growth can, however, be found in studies by Carree et al. (2002) and Wennekers et al. (2005) and has also appeared in GEM reports. By deriving a U-shaped curve, the authors of these reports have shown a link between the rate of total early-stage entrepreneurial activity (TEA) and economic development represented by the per capita GDP at purchasing power parity. The relationship is partially explained by the stage of economic development.

The form of this curve implies that the impact of entrepreneurial activities on GDP varies according to degree of economic development (Carree et al., 2002; Wennekers et al., 2005). Along these lines, Wennekers et al. (2005) indicated that entrepreneurs’ influence on a nation’s economy varies according to its degree of development: Entrepreneurial activity causes a negative or negligible effect in economies in early stages of development, whereas such activity exerts a positive effect in more advanced economies (Acs and Varga, 2005; van Stel et al., 2005; Acs and Szerb, 2007; Valliere and Peterson, 2009).

Scholars of economic activity have traditionally followed one of two classifications: advanced economies and emerging market economies; or the classification of economies into three levels (Porter et al., 2002). Until 2007, the GEM reports used the first of the two classifications -that of advanced economies and emerging market economies- whereas in 2008, the reports began to use the three-level classification. Taking the U-shaped curve as a basis, however, two types of economies emerge: economies where entrepreneurial activity has a negative or negligible effect on economic growth, and those with a positive impact. Carree et al. (2002), Wennekers et al. (2005), and van Stel et al. (2005) focused on how the impact of business creation differs according to development. Building on this approach in our research, we established a complementary classification, which centered on the relationship between entrepreneurship and economic development as opposed to the stage of economic development. We thus defined two types of economies in terms of entrepreneurship, depending on whether entrepreneurial activity has a positive or negative influence on economic development.

Empirical evidence implies that there exists a relationship between entrepreneurship and population growth. By increasing the volumes of customer demand, pressure arising from population growth may encourage business creation and may present new opportunities to expand the market (Reynolds et al., 1995; Armington and Acs, 2002; Wennekers et al., 2005). Several authors have asserted that the larger the population growth, the greater level of entrepreneurship (Wennekers et al., 2005; Bosma et al., 2008), especially if driven by immigration (Wennekers et al., 2005).

Population agglomeration, understood as population density, is another demographic aspect that influences entrepreneurial activity. Agglomeration is important for economic activity (Armington and Acs, 2002). Moreover, people living in urban areas are more likely to become entrepreneurs (Wagner and Sternberg, 2004; Arenius and De Clercq, 2005). Research has shown an association between highly populated regions and high rates of business creation (Reynolds et al., 1994; Armington and Acs, 2002; Audretsch and Keilbach, 2004; Bosma et al., 2008; Bosma and Schutjens, 2011), less risk aversion, and stronger GDP growth (Bosma and Schutjens, 2011). Nevertheless, in a study of Japanese firms, Sato et al. (2012) found that the economics of density can have a positive effect on potential entrepreneurship, but a minimal impact on effective entrepreneurship. Furthermore, new businesses are more prevalent in urban areas than in rural areas (Audretsch and Fritsch, 1994; Bruderl and Preisendorfer, 1998; Fritsch and Mueller, 2008).

Analyzing individuals according to age, on the other hand, has yielded findings that show that young people are the most entrepreneurial, in that they detect the most business opportunities and display preferences for self-employment (Blanchflower et al., 2001; Hernández-Mogollón, Fernández-Portillo, Díaz-Casero and Sánchez-Escobedo, 2018; Calzado-Barbero, Fernández-Portillo and Almodóvar-González, 2019). Moreover, they have the lowest cost of opportunity for engaging in entrepreneurship (Amit et al. 1995), their risk aversion is less burdensome than in other age groups (Levesque and Minniti, 2006), and they express greater entrepreneurial intention and have more growth potential than older individuals (David and Shaver, 2012). Once people reach a certain age, the probability that they will engage in entrepreneurial activity decreases (Levesque and Minniti, 2006; Mueller, 2006; Vaillant and Lafuente, 2007). Although they do not compose the youngest age group, 25 to 34 year olds create the most business, according to numerous studies (Reynolds, 1997; Delmar and Davidsson, 2000; Wennekers et al., 2002; Levesque and Minniti, 2006).

In practice, researchers have rarely analyzed only one demographic factor. In some studies they have explored several demographic factors, whereas in others such factors are grouped with variables of a different nature. Reynolds et al. (1994), for instance, concluded that population growth in densely populated urban settings in societies where small enterprises are dominant is conducive to entrepreneurial activity. Wennekers et al. (2002), on the other hand, posited that demographic factors including age distribution, ethnicity, population growth, education level, and age play a key role in driving entrepreneurial activity. For Armington and Acs (2002), the relevant demographic factors at both national and regional levels include population growth, age distribution, and education. Arenius and Minitti (2005), however, linked the decision to undertake an entrepreneurial venture with demographic and economic traits, whereas Bosma and Schutjens (2011) showed the importance of institutional, economic, and demographic variables in the activity and attitude of entrepreneurs.

The data used in this study came from the GEM project and the World Bank:

TEA (Total Entrepreneurial Activity): According to the GEM project, this indicator reflects the level of entrepreneurial activity in participating countries. A survey, which follows a standardized methodology for all participating countries, gathers data from representative samples of the adult population (Adult Population Survey). The aggregated variable at the national level is TEA, which reflects the percentage of individuals from the population aged between 18 and 64 who state that they are involved in an entrepreneurial venture of any kind (including self-employment). This activity must have a longevity of 42 months or less.

GDP (Gross Domestic Product): Taken from the World Bank (per capita GDP ppp), this variable measures economic growth through the calculation of per capita GDP at purchasing power parity, using current prices in US dollars. The data came from the World Development Indicators and Global Financial Development database.

The demographic factors were composed of 15 variables drawn from the World Bank’s World Development Indicators and Global Financial Development database. Table 1 shows the three demographic factors and their constituent variables, along with their definition and variable name used in this study.

Table 1

Demographic variables

Factor |

Description of constituent variables |

Definition |

Variable name |

Population growth |

Birth rate |

Births per 1000 inhabitants |

Dem01 |

Fertility rate |

Births per female |

Dem02 |

|

Population growth |

Percentage of annual population growth |

Dem03 |

|

Mortality rate |

Mortality per 1000 inhabitants |

Dem04 |

|

Age distribution |

Population less than 15 years old |

Percentage of the population (as % of total) aged less than 15 |

Dem05 |

Population between 15 and 64 |

Percentage of the population (as % of total) aged between 15 and 64 |

Dem06 |

|

Population more than 64 years old |

Percentage of the population (as % of total) aged more than 64 |

Dem07 |

|

Dependency ratio |

Percentage of dependent population (as % of total working-age population) |

Dem08 |

|

Dependency ratio (elderly) |

Percentage of dependent elderly population (as % of total working-age population) |

Dem09 |

|

Dependency ratio (youth) |

Percentage of dependent youth population (as % of total working-age population) |

Dem10 |

|

Agglomeration |

Population density |

Population per square kilometer |

Dem11 |

Rural population |

Percentage of the population (as % of total) living in rural areas |

Dem12 |

|

Growth of rural population |

Percentage of annual growth in the rural population |

Dem13 |

|

Urban population |

Percentage of the population (as % of total) living in urban areas |

Dem14 |

|

Growth of urban population |

Percentage of annual growth in the urban population |

Dem15 |

Source: Authors’ own work

This research included all countries for which data was available for a time frame of six years. Each statistical case referred to a country in a particular year. There were therefore 248 cases, consisting of data from all the countries that participated in the GEM project between 2004 and 2009. The exceptions were Puerto Rico in 2007 and Palestinian Territories in 2009 because GDP data was missing in these cases.

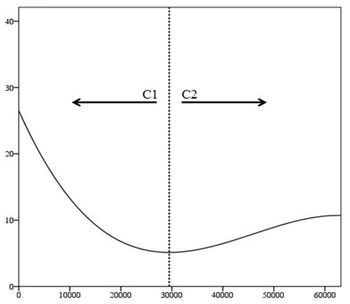

Following Almodóvar-González et al. (2020) we classified the countries into two groups depending on the relationship between GDP and TEA. If the relationship was inverse, we included the country in group 1 (C1). If, on the other hand, the relationship was direct, we included the country in group 2 (C2). We interpreted the concept of developed economies as countries characterized by productive entrepreneurship (in terms of economic development) and we treated the concept of developing economies as unproductive entrepreneurship (in terms of economic development). As Almodóvar-González et al. (2020), we determined the classification according to the position occupied by the point of inflexion (local minimum) of the U-shaped curve. The cases to the left of the minimum had an inverse relationship between their GDP and their TEA, and hence made up group 1 (C1), whereas the cases to the right, with a direct relationship, were included in group 2 (C2). We repeated this process for each year of data.

Figure 1 offers a visual representation of the classification for 2009. The analysis was less representative for years with a higher number of cases concentrated around the minimum because the discrimination was smaller. Countries with data that lie close to the minimum may have very similar features despite belonging to different groups. These countries may be in transition; in other words, efficiency-driven economies (Porter et al., 2002).

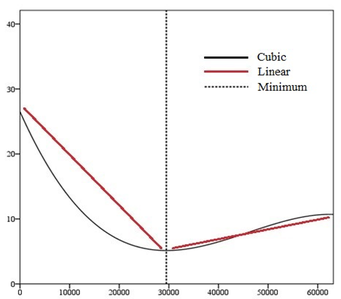

According to Almodóvar-González et al. (2019), At the conceptual level, dividing the countries into two groups allowed us to interpret the cubic model in terms of two straight lines (see Figure 2): one with an inverse relationship (C1) and the other with a direct relation (C2) (Almodóvar-González et al., 2020)

Figure 1

Classification 2009

Source: Almodóvar-González et al. (2020)

-----

Figure 2

Cubic-linear for GDP and TEA

Source: Almodóvar-González et al. (2020)

To examine the influence of demographic factors on economic development and entrepreneurial activity, we follow Almodóvar-González et al. (2020). We took GDP and TEA as dependent variables, and considered the demographic variables as the model’s independent variables. We thus analyzed the influence of each demographic variable on GDP and TEA simultaneously. The choice of approach here owed to our objective of seeking demographic variables with relationships with both of the dependent variables.

The empirical study was based on pooled analysis with ordinary least squares, which we employed to estimate the model for the six years of data. To mitigate the limitations of the assumptions behind this method (i.e., bias due to unobservable heterogeneity), we set several quality criteria with the aim of selecting only models with stable regressions over time. This design is based in Díaz et al. (2013) model and performance by Almodóvar-González et al. (2020).

Criterion 1. Value of the pooled correlation coefficient (R-pooled): We first calculated the correlations between the demographic variables and GDP and TEA for each group of countries, aggregated over all six years. We then selected the variables according to the Pearson correlation coefficients, discarding the variables with correlation coefficients greater than 0.2 at a significance of 0.01 for both GDP and TEA.

Criterion 2. Sample size represented by the pooled correlation coefficient (n-pooled): In addition to the R-pooled criterion, we also required that the calculation for the correlation coefficient included no fewer than 75% of the cases for both GDP and TEA. This criterion was important because the demographic variables were unavailable in some cases owing to missing values. The first group had 139 possible cases, and the minimum was hence 104.25 cases. The second group, comprising 109 cases, had a required minimum of 81.75 cases.

Criterion 3. Annual correlation coefficient (Ri): For each year, we calculated the correlation coefficients of the independent variables with GDP and TEA simultaneously. We performed the calculation for each year. We required that these yearly coefficients had the same sign as the pooled correlation (R-pooled).

Criteria 4. Yearly regressions: We computed yearly linear regressions for the independent variables against GDP and TEA simultaneously. The adjusted regression coefficients (accounting for error) of these annual regressions for GDP and TEA were required to be nonzero for each year.

Criterion 5. Pooled regression: We calculated the pooled correlation coefficient of the adjusted linear regression (accounting for error) for each independent variable with GDP and TEA simultaneously. The resulting regression coefficient must be greater than 0.15 for both GDP and TEA.

For the pooled regression of any demographic variable to be accepted as stable and representative, we required it to fulfil every one of the criteria for both GDP and TEA. The relevance of the model was evaluated in terms of the adjusted correlation coefficient of the error term.

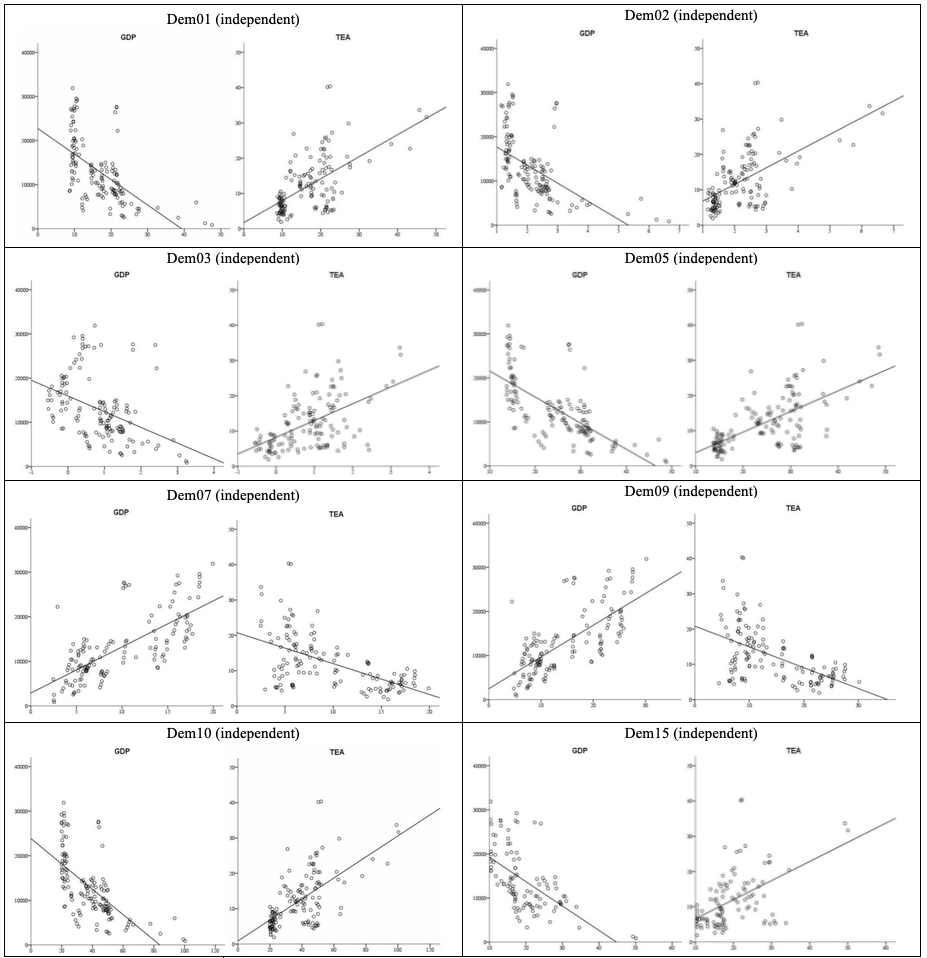

Of the 15 demographic variables under study, six meet Criteria 1 to 5 in group C1 and two meet all the criteria in C2. In a first-stage approximation of the results, the relationship between any of the demographic variables in C1 (developing economies) and GDP differed from the association of the same variable with TEA. In other words, if the relationship with GDP was inverse (direct), the relationship with TEA was direct (inverse). In C2 (developed economies), however, demographic factors exerted an influence on GDP in the same direction as their influence on TEA: If the relationship with GDP was inverse, it was also inverse with TEA.

Below, we discuss the variables that met the criteria defined previously, the values with which they met these criteria, and the pooled regressions yielded by the analysis. The results are presented independently for the two groups of countries.

The variable Dem01 was found to be inversely related to GDP and therefore directly related to TEA. This means that higher rates of adolescent fertility were associated with lower income levels and greater rates of entrepreneurial activity. This model explained 34.8% of the variance (adjusting for the error term) in GDP and 34.6% in TEA.

Table 2

Linear regressions demographic variables with GDP and TEA for group 1 (C1)

Variables |

Pooled regression |

Pooled correlation |

Yearly regressions |

|||||||||||

Independent |

Dependent |

Sign |

R2 |

Adjusted R2 |

α |

R |

α |

n |

Adjusted R2 2004 |

Adjusted R2 2005 |

Adjusted R2 2006 |

Adjusted R2 2007 |

Adjusted R2 2008 |

Adjusted R2 2009 |

Dem01 |

GDP |

- |

0.348 |

0.343 |

0.000 |

-0.590 |

0.000 |

139 |

0.701 |

0.254 |

0.470 |

0.228 |

0.268 |

0.334 |

TEA |

+ |

0.346 |

0.341 |

0.000 |

0.588 |

0.000 |

139 |

0.444 |

0.077 |

0.157 |

0.194 |

0.378 |

0.407 |

|

Dem02 |

GDP |

- |

0.287 |

0.281 |

0.000 |

-0.535 |

0.000 |

139 |

0.608 |

0.282 |

0.457 |

0.155 |

0.196 |

0.281 |

TEA |

+ |

0.326 |

0.321 |

0.000 |

0.571 |

0.000 |

139 |

0.390 |

0.112 |

0.193 |

0.168 |

0.367 |

0.366 |

|

Dem03 |

GDP |

- |

0.168 |

0.161 |

0.000 |

-0.409 |

0.000 |

139 |

0.687 |

0.143 |

0.259 |

0.004 |

0.131 |

0.078 |

TEA |

+ |

0.257 |

0.252 |

0.000 |

0.507 |

0.000 |

139 |

0.427 |

0.264 |

0.091 |

0.177 |

0.319 |

0.169 |

|

Dem05 |

GDP |

- |

0.475 |

0.471 |

0.000 |

-0.689 |

0.000 |

139 |

0.854 |

0.412 |

0.560 |

0.360 |

0.414 |

0.431 |

TEA |

+ |

0.398 |

0.394 |

0.000 |

0.631 |

0.000 |

139 |

0.532 |

0.172 |

0.212 |

0.350 |

0.492 |

0.384 |

|

Dem07 |

GDP |

+ |

0.524 |

0.521 |

0.000 |

0.724 |

0.000 |

139 |

0.834 |

0.567 |

0.612 |

0.550 |

0.444 |

0.398 |

TEA |

- |

0.320 |

0.315 |

0.000 |

-0.566 |

0.000 |

139 |

0.458 |

0.241 |

0.162 |

0.384 |

0.336 |

0.245 |

|

Dem09 |

GDP |

+ |

0.513 |

0.509 |

0.000 |

0.716 |

0.000 |

139 |

0.800 |

0.565 |

0.588 |

0.569 |

0.431 |

0.376 |

TEA |

- |

0.295 |

0.290 |

0.000 |

-0.543 |

0.000 |

139 |

0.431 |

0.238 |

0.143 |

0.368 |

0.296 |

0.211 |

|

Dem10 |

GDP |

- |

0.420 |

0.416 |

0.000 |

-0.648 |

0.000 |

139 |

0.754 |

0.353 |

0.522 |

0.305 |

0.356 |

0.404 |

TEA |

+ |

0.394 |

0.389 |

0.000 |

0.628 |

0.000 |

139 |

0.491 |

0.145 |

0.218 |

0.319 |

0.481 |

0.409 |

|

Dem15 |

GDP |

- |

0.330 |

0.325 |

0.000 |

-0.574 |

0.000 |

139 |

0.581 |

0.457 |

0.454 |

0.155 |

0.280 |

0.256 |

TEA |

+ |

0.264 |

0.259 |

0.000 |

0.514 |

0.000 |

139 |

0.299 |

0.248 |

0.082 |

0.257 |

0.312 |

0.255 |

|

Source: Authors’ own work

Results show an inverse relationship between Dem02 and GDP (R2 = 0.287) and a direct relationship between Dem02 and TEA (adjusted R2 = 0.326). Conceptually, Dem01 and Dem02 are closely linked. According to the power of this variable to explain entrepreneurship and growth, the birth rate was more relevant than the fertility rate, although both variables acted negatively on GDP and positively on TEA.

The variable Dem03 was inversely related to GDP and directly related to TEA. Therefore, higher population growth rates were associated with lower levels of income and higher rates of entrepreneurial activity. The model explained 16.8% of the variance (adjusting for the error term) in the GDP and 25.7% in the TEA. This variable had the weakest explanatory power of all the variables that met the criteria of the proposed model.

The next four variables (Dem05, Dem07, Dem09, Dem10), referring to age distribution in the population, were observed to be the most powerful in terms of explaining the variance. We found results for young and elderly populations to be complementary. In other words, results show that the model is logical. First, upon comparing the population comprising people younger than 15 with that of individuals older than 64, we found that the relationship with GDP in the first group was negative (and positive in the second), whereas the relationship with TEA in the younger group was positive (and negative in the older group). The same result holds for the young-old comparison for the dependency ratio.

According to the results of the variable Dem15, higher population growth in urban areas was linked to lower income levels (R2 = 33.3%) and higher levels of entrepreneurial activity (R2 = 26.4%). This variable, as for all previously discussed demographic variables, was observed to have a positive relationship with either GDP or TEA and a negative relationship with the other dependent variable.

Figure 3

Linear regressions demographic variables with GDP and TEA for group 1 (C1)

Source: Authors’ own work

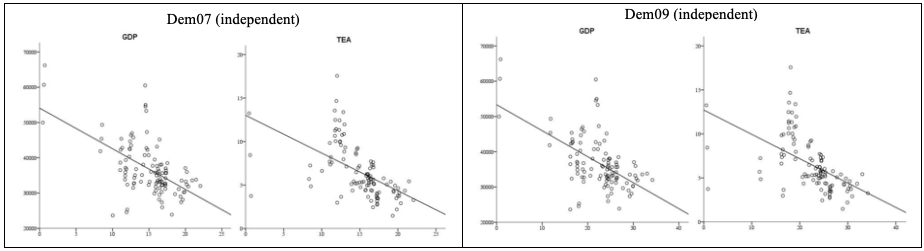

The two independent demographic variables that met the criteria for the second group (C2) both relate to age; more specifically, the condition of aging. Both the variable population older than 64 and the variable dependency ratio of elderly people were seen to have negative links to growth and entrepreneurship, with almost identical coefficients of determination. A higher proportion of elderly inhabitants and/or a greater rate of dependence among elderly inhabitants was linked to lower levels of economic growth and lower levels of entrepreneurship in developed countries.

Table 3

Linear regressions demographic variables with GDP and TEA for group 2 (C2)

Variables |

Pooled regression |

Pooled correlation |

Yearly regressions |

|||||||||||

Independent |

Dependent |

Sign |

R2 |

Adjusted R2 |

α |

R |

α |

n |

Adjusted R2 2004 |

Adjusted R2 2005 |

Adjusted R2 2006 |

Adjusted R2 2007 |

Adjusted R2 2008 |

Adjusted R2 2009 |

Dem07 |

GDP |

- |

0.328 |

0.321 |

0.000 |

-0.572 |

0.000 |

109 |

0.128 |

0.266 |

0.692 |

0.590 |

0.237 |

0.376 |

TEA |

- |

0.291 |

0.285 |

0.000 |

-0.540 |

0.000 |

109 |

0.245 |

0.433 |

0.011 |

0.281 |

0.444 |

0.628 |

|

Dem09 |

GDP |

- |

0.324 |

0.318 |

0.000 |

-0.570 |

0.000 |

109 |

0.140 |

0.263 |

0.674 |

0.578 |

0.229 |

0.390 |

TEA |

- |

0.287 |

0.280 |

0.000 |

-0.536 |

0.000 |

109 |

0.215 |

0.409 |

0.017 |

0.315 |

0.448 |

0.595 |

|

Source: Author’s own work

-----

Figure 4

Linear regressions demographic variables

with GDP and TEA for group 2 (C2)

Source: Authors’ own work

Results show that demographic factors exert different influences in different types of economies. By relating these demographic variables to economic growth and entrepreneurship, we have reached the following conclusions. First, demographic factors have a greater impact in less developed countries. Their influence is greater, not only at the quantitative level-a greater number of variables exhibit causality-but also at a qualitative level because in these economies the relationships are stronger.

Table 4

Summary of results. Sign and relation of R2

Group |

Concept |

Independent variable |

GDP |

TEA |

C1 |

Population growth |

Dem01: Birth rate |

(-) 0.348 |

(+) 0.346 |

Dem02: Fertility rate |

(-) 0.287 |

(+) 0.326 |

||

Dem03: Population growth |

(-) 0.168 |

(+) 0.257 |

||

Age distribution |

Dem05: Population less than 15 |

(-) 0.475 |

(+) 0.398 |

|

Dem07: Population greater than 64 |

(+) 0.524 |

(-) 0.320 |

||

Dem09: Dependency ratio (elderly) |

(+) 0.513 |

(-) 0.295 |

||

Dem10: Dependency ratio (youth) |

(-) 0.420 |

(+) 0.394 |

||

Agglomeration |

Dem14: Urban population growth |

(-) 0.330 |

(+) 0.264 |

|

C2 |

Age distribution |

Dem07: Population greater than 64 |

(-) 0.328 |

(-) 0.291 |

Dem09: Dependency ratio (elderly) |

(-) 0.324 |

(-) 0.287 |

Source: Authors’ own work

The aforementioned impact has repercussions that lie beyond determining the weight of influence of the demographic factors in each type of economy. The scope of the impact of demographics differs between the two economic groups. For the developed economies demographic factors exert an impact in the same direction (negative) on both economic growth and entrepreneurship. In the developing economies, however, the effect on entrepreneurship is the inverse of the effect on economic growth; if the demographic factor drives economic growth, it also hinders entrepreneurship (and vice versa). The variables Dem07 (population greater than 64 years old) and Dem09 (dependency ratio for elderly people) exemplify this phenomenon. They are comparable because they are present in groups C1 and C2, and the way their impact differs depending on the stage of economic development is clearly observable.

The results of our study suggest the existence of relationships between certain demographic factors, entrepreneurship, and economic growth. These relationships differ according to whether a country is developing or developed. Policymakers should hence account for characteristics of the population to ensure productive entrepreneurship that drives economic growth.

For developed economies, our results provide evidence of a negative relationship between the proportion of economically inactive adults and the amount of entrepreneurship. Likewise, our analysis yields a negative relationship between the proportion of economically inactive adults and the level of economic growth. Seemingly, this connection is the outcome of an imbalance in the population structure: Societies with large numbers of elderly inhabitants -therefore less entrepreneurial (Mueller, 2006; Vaillant and Lafuente, 2007) and more dependent- are likely to have fewer members of the population in the most entrepreneurially active age band of 25 to 34 (Wennekers et al., 2002; Levesque and Minniti, 2006). Furthermore, this imbalance builds pressure on the economically active section of the population because fewer people have to provide for larger number of individuals. For this reason, public authorities should consider the population pyramid when making policymaking decisions because of its relevance in issues of entrepreneurship and economic growth. According to the aforementioned argument, policies designed to stimulate entrepreneurship will be less effective in aging populations than in younger populations. In aging populations, we propose two complementary policy actions to help boost entrepreneurship and growth. First, policymakers should aim to increase the birth rate and combine this with the promotion of immigration due to its potential to boost entrepreneurship (Wennekers et al., 2005). Second, politicians should seek to foster entrepreneurial activity in segments of the elderly population (Kautonen et al., 2011).

Developing economies are quite distinct from developed economies. The combination of high population growth and young, agglomerated populations is related to lower levels of economic growth and greater entrepreneurship. This finding is consistent with the literature, in which articles have shown high levels of necessity entrepreneurship with scarce impact on economic growth in developing economies (Carree et al., 2002; Wennekers et al., 2005; Acs and Szerb, 2007; Valliere and Peterson, 2009). This may be argued by invoking the theory of demographics: A large population with scarce resources is forced to engage in entrepreneurial undertakings because of necessity and the scant opportunities available in such a low-growth economic environment.

Table 5 displays a summary of the key relationships that have emerged from our analysis. Comparing these results with those found in the literature highlights some divergence, particularly with respect to developing economies.

Table 5

Summary of conclusions

Type of economy |

Demographics |

Growth/Entrepreneurship |

Relationship |

Developing |

High population growth |

Economic growth |

Negative |

Entrepreneurship |

Positive |

||

Young population |

Economic growth |

Negative |

|

Entrepreneurship |

Positive |

||

Greater urban population density |

Economic growth |

Negative |

|

Entrepreneurship |

Positive |

||

Developed |

Aging population |

Economic growth |

Negative |

Entrepreneurship |

Negative |

Source: Authors’ own work

For developing economies, our study shows that an age distribution with a greater weight in younger age groups leads to greater entrepreneurial activity. Previous studies have indicated that the most entrepreneurial age group comprises individuals aged between 25 and 34 (Reynolds, 1997; Delmar and Davidsson, 2000). Our results indicate that entrepreneurial activity is greater in societies whose population is more concentrated around the age group of 15 years old or younger and that have a smaller proportion of people older than 64. Clearly, this does not imply that the age group comprising the most entrepreneurial individuals is that of less than 15 years old but rather that societies in developing countries tend to me more entrepreneurial when this age group is larger.

Agglomeration, represented in this study by the growth of the urban population, has been consistently shown to increase levels of entrepreneurship (Armington and Acs, 2002; Audretsch and Keilbach, 2004; Arenius and De Clercq, 2005). Our study supports these findings, although we observed that entrepreneurship’s overall effect on economic growth was in fact negative. Bosma and Schutjens (2011), conversely, found a positive relationship between agglomeration, certain elements of entrepreneurship, and GDP at the regional level. Unlike some previous research, however, our findings apply specifically to developing economies.

In developed countries, we have failed to uncover relationships to do with population growth and agglomeration. As stated in Section 2, prior studies have shown the existence of such relationships. Our results do not contradict such findings, although they do not offer support for these statements when they apply simultaneously to entrepreneurship and economic growth both at the country level. Research has shown that individuals above a certain age are less likely to engage in entrepreneurship (Levesque and Minniti, 2006; Mueller, 2006; Vaillant and Lafuente, 2007). Our findings on age distribution lend support to this assertion, imply that aging populations not only engage less in entrepreneurship but also have lower incomes.

The divergence of our results from the findings established in the literature may owe to three reasons. First, our study only sheds light on variables that exert an influence on both entrepreneurial activity and economic growth; that is, we do not analyze the impact of demographic factors exclusively on entrepreneurship. Second, we studied the influence of demographic traits separately for each of the two types of economy defined in this research. Understandably, this may have led to observing causation that differs from that found in research where no such distinction was applied. A third and final explanation can be found in Glaeser et al. (2010). Although we attempted to find causation at the country level, the authors of the aforementioned study indicated that it is unclear at which geographical level cause and effect of entrepreneurship can be observed.

As stated in the previous section, some aspects of our study may be perceived as divergent from existing research. Importantly, however, our study does not refute any findings published in previous studies. Our methodology has yielded findings that may not be directly compared to those of other studies because our conclusions have been drawn from variables that simultaneously affect entrepreneurship and development. We hence excluded factors that intervene only in the creation of business or that influence just economic development.

In addition to the variables studied in this research, there nevertheless exist other relevant demographic variables such as sex or education. Thus, the term some demographic factors would in fact be more suitable for use in connection with our research than the term demographic factors, which is more general. We consequently advocate an increase in the number of factors included in future studies.

Another aspect worth noting is the use of pooled regressions, a technique that fails to account for the effect of unobservable heterogeneity. In an attempt to employ a robust method to mitigate this effect, we performed independent annual estimates by applying a series of criteria to filter out the relationships unsupported by the data.

Acs, Z., & Varga, A. (2005). Entrepreneurship, Agglomeration and Technological Change. Small Business Economics, 24, 323-334.

Acs, Z., & Szerb, L. (2007). Entrepreneurship, Economic Growth and Public Policy. Small Business Economics, 28, 109-122.

Almodóvar, M. (2018). Tipo de emprendimiento y fase de desarrollo como factores clave para el resultado de la actividad emprendedora. Cuadernos de Relaciones Laborales, 36, 225-244.

Almodóvar-González, M., Fernández-Portillo, A. & Díaz-Casero, J.C. (2020). Entrepreunerial activity and economic growth. A multi-country analysis. European Research on Management and Business Economics. Forthcoming.

Amit, R., Muller, E., & Cockburn, I. (1995). Opportunity costs and entrepreneurial activity. Journal of Business Venturing, 10, 95-106.

Arenius, P., & De Clercq, D. (2005). A network-based approach on opportunity recognition. Small Business Economics, 24, 249-265.

Arenius, P., & Minitti, M. (2005). Perceptual variables and nascent entrepreneurship. Small Business Economics, 24, 233-247.

Armington, C., & Acs, Z.J. (2002). The Determinants of Regional Variation in New Firm Formation. Regional Studies, 36(1), 33-45.

Audretsch, D.B., & Fritsch, M. (1994). The Geography of Firm Births in Germany. Regional Studies, 28(4), 359-365.

Audretsch, D.B. (2009). The entrepreneurial society. Journal of Technology Transfer, 34, 245-254.

Audretsch, D.B., & Keilbach, M.C. (2004). Entrepreneurship Capital and Economic performance. Regional Studies, 38(8), 949-959.

Baumol, W.J. (1990). Entrepreneurship: Productive, Unproductive and Destructive. The Journal of Politics Economy, 98, 893-921.

Blanchflower, D.G., Oswald, A.J., & Stutzer, A. (2001). Latent entrepreneurship across nations. European Economic Review, 45, 680-691.

Bosma, N., Acs, Z.J., Autio, E., Coduras, A., & Levie, J. (2009). Global Entrepreneurship Monitor 2008 Executive Report. Babson Park, MA: Babson College, Santiago, Chile: Universidad del Desarrollo and London, UK: London Business School.

Bosma, N., & Levie, J. (2010). Global Entrepreneurship Monitor 2009 Executive Report. Babson Park, MA, US: Babson College, Santiago, Chile: Universidad del Desarrollo and Reykjavík, Iceland: Háskólinn Reykjavík University, London, UK: Global Entrepreneurship Research Association.

Bosma, N., & Schutjens, V. (2011). Understanding regional variation in entrepreneurial activity and entrepreneurial attitude in Europe. The Annals of Regional Science, 47(3), 711-742.

Bosma, N., Van Stel, A., & Suddle, K. (2008). The Geography of New Firm Formation: Evidence from Independent Start-Ups and New Subsidiaries in the Netherlands. International Entrepreneurship and Management Journal, 4(2), 129-146.

Bruderl, J., & Preisendorfer, P. (1998). Network Support and the Success of Newly Founded Businesses. Small Business Economics, 10(3), 213-225.

Bruton, G.D., Ahlstrom, D., & Obloj, K. (2008). Entrepreneurship in emerging economies: Where are we today and where should the research go in the future. Entrepreneurship: Theory and Practice, 32, 1-14.

Calzado-Barbero, M.; Fernández-Portillo, A.; & Almodóvar-González, M. (2019). Educación emprendedora en la universidad. Journal of Management and Business Education, 2(2), 127-159.

Carree, M., Van Stel, A., Thurik, R., & Wennekers, S. (2002). Economic Development and Business Ownership: an Analysis Using Data of 23 OECD Countries in the Period 1976-1996. Small Business Economics, 19(3), 271-290.

Davis, A.E., & Shaver, K.G. (2012). Understanding Gendered Variations in Business Growth Intentions Across the Life Course. Entrepreneurship: Theory and Practice, 36(3), 495-512.

Delmar, F., & Davidsson, P. (2000). Where do they come from? Prevalence and characteristics of nascent entrepreneurs. Entrepreneurship and Regional Development, 12, 1-23.

Desai, S., Acs, Z.J., & Weitzel, U. (2013). A Model of Destructive Entrepreneurship: Insight for Conflict and Postconflict Recovery. Journal of Conflict Resolution, 57, 20-40.

Díaz, J.C., Almodóvar, M., Sánchez, M.C., Coduras, A., & Hernández, R. (2013). Institutional variables, entrepreneurial activity and economic development. Management Decision, 51(1/2), 281-305.

Fritsch, M., & Mueller, P. (2008). The Effect of New Business Formation on Regional Development over Time: The Case of Germany. Small Business Economics, 30(1), 15-29.

Glaeser, E.L., Rosenthal, S.S., & Strange, W.C. (2010). Urban economics and entrepreneurship. Journal of Urban Economics, 67(1), 1-14.

Henrekson, M., & Sanandaji, T. (2011). The interaction of entrepreneurship and institutions. Journal of Institutional Economics, 7, 47-75.

Hernández-Mogollón, R., Fernández-Portillo, A., Sánchez-Escobedo, M. C., & Coca-Pérez, J. L. (2017). The Approach of the Entrepreneur Microecosystem for University Entrepreneurial Education: Model M2E EMFITUR. In Economy, Business and Uncertainty: New Ideas for a Euro-Mediterranean Industrial Policy (pp. 250-275). Springer, Cham.

Kautonen, T., Tornikoski, E.T., & Kibler, E. (2011). Entrepreneurial intentions in the third age: the impact of perceived age norms. Small Business Economics, 37(2), 219-234.

Levesque, M., & Minniti, M. (2006). The effect of aging on entrepreneurial behavior. Journal of Business Venturing, 21(2), 177-194.

Minniti, M. (2012). El emprendimiento y el crecimiento económico de las naciones. Economía Industrial, 383, 23-30.

Mueller, P. (2006). Entrepreneurship in the region: Breeding ground for nascent entrepreneurs? Small Business Economics, 27, 41-58.

Naudé, W. (2011). Entrepreneurship is Not a Binding Constraint on Growth and Development in the Poorest Countries. World Development, 39, 33-44.

Nissan, E., Martín, M.A.G., & Picazo, M.T.M. (2011). Relationship between organizations, institutions, entrepreneurship and economic growth process. International Entrepreneurship and Management Journal, 7(3), 311-324.

Porter, M.E., Sachs, J.D., & McArthur, J.W. (2002). The Global Competitiveness Report 2001–2002. New York: Oxford University Press, 16-25.

Reynolds, P.D., Storey, D.J., & Westhead, P. (1994). Cross-national variations in new firm formation rates. Regional Studies, 28, 443-456.

Reynolds, P.D. (1997). Who starts new firms? Linear additive versus interaction based models. Small Business Economics, 9, 449-462.

Reynolds, P.D., Hay, M., & Camp, R.M. (2002). Global Entrepreneurship Monitor. 2002 Executive Report, London: London School Business. Babson College, Kauffman Center for Entrepreneurial Leadership.

Reynolds, P.D., Miller, B., & Maki, W.R. (1995). Explaining Regional Variation in Business Births and Deaths: U.S. 1976-88. Small Business Economics, 7(5), 389-407.

Sato, Y., Tabuchi, T., & Yamamoto, K. (2012). Market size and entrepreneurship. Journal of Economic Geography, 12(6), 1139-1166.

Sobel, R. (2008). Testing Baumol: Institutional Quality and the Productivity of Entrepreneurship. Journal of Business Venturing, 23, 641-665.

Vaillant, Y., & Lafuente, E. (2007). Do different institutional frameworks condition the influence of local fear of failure and entrepreneurial examples over entrepreneurial activity?. Entrepreneurship and Regional Development,19(4), 313-337.

Valliere, D., & Peterson, R. (2009). Entrepreneurship and economic growth: Evidence from emerging and developed countries. Entrepreneurship and Regional Development, 21(5/6), 459-480.

Van Stel, A., Carree, M., & Thurik, R. (2005). The Effect of Entrepreneurial Activity on National Economic Growth. Small Business Economics, 24, 311-321.

Wagner, J., & Sternberg, R. (2004). Start-up activities, individual characteristics, and the regional milieu: Lessons for entrepreneurship support policies from German micro data. Annals of Regional Science, 38, 219-240.

Wennekers, S., Stel, A., Thurik, A.R., & Reynolds, P. (2005). Nascent Entrepreneurship and the Level of Economic Development. Small Business Economics, 24, 293-309.

Wennekers, S., Uhlaner, L., & Thurik, R. (2002). Entrepreneurship and its conditions: A macro perspective. International Journal of Entrepreneurship Education, 1(1), 25-64.

1. Researcher in the line of entrepreneurial activity and economic grown. Department of Financial Economics and Accounting. University of Extremadura. Doctor in Financial Economics and Accounting. manuelag@unex.es

2. Researcher in the line of entrepreneurial activity and gender. Department of Financial Economics and Accounting. University of Extremadura. Doctor in Financial Economics and Accounting. maricruzse@unex.es

3. Researcher in the line of entrepreneurial activity and digitalization of SMEs. Department of Financial Economics and Accounting. University of Extremadura. Doctor in Financial Economics and Accounting. antoniofp@unex.es