Vol. 40 (Number 7) Year 2019. Page 30

BULISKERIYA, Gvantsa N. 1; SINELNIKOV, Alexander A. 2; ANDREEV, Alexander F. 3

Received: 09/10/2018 • Approved: 24/02/2019 • Published 04/03/2019

ABSTRACT: Purpose is improving the effectiveness of creating and acquiring new technologies, and equipment in oil production to simulate the processes of insourcing, outsourcing, and technology transfer taking into account some strategic goals, financial and economic conditions for creating (acquiring) innovations and forms of organization of oilfield services. The model is a tool for preparing strategic, technologically-oriented decisions on strategic plans for the development of enterprise, evaluating and selecting solutions for managing the technologic support of large oil and gas projects. |

RESUMEN: El objetivo: aumentar la eficiencia de crear y adquirir nuevas tecnologías y equipos para la producción de petróleo para gestionar los procesos de externalización, inserción y transferencia de tecnología, teniendo en cuenta ciertos objetivos estratégicos, las condiciones financieras y económicas para la creación (adquisición) de innovaciones y formas de organización de los servicios petroleros. El modelo es una herramienta para preparar las soluciones estratégicas orientadas a la tecnología para los planes estratégicos para el desarrollo de la empresa, evaluar y seleccionar las soluciones para gestionar el apoyo tecnológico de grandes proyectos de petróleo y gas. |

The paper is devoted to the issues of managing the implementation of capital-intensive investment projects at the level of Vertically integrated oil companies (VIOCs). At present, the Russian oil and gas industry continues to restructure production. The activity in the search and extraction of oil and gas is intensified. More attention is focused on accelerating the promotion of new production and information technologies. An appropriate innovative and engineering environment is formed, which supports production and project activities. The most successful are those enterprises that best carry out their work on estimation, selection, and implementation of organizational and technologic priorities. The corresponding information and analytical tools should be based on models adapted to the specific characteristics and strategies of each enterprise, with the involvement of new schemes and criteria for the preparation and implementation of solutions.

The experience of Russian vertically integrated oil and gas companies indicates that the rationality of field development, the costs of hydrocarbon production and other factors of long-term profitability of oil and gas production are determined primarily by the technologic level achieved as a result of the large-scale use of technical, technologic-organizational, and managerial innovations. The increasing influence on companies' business of the conditions of development of hydrocarbon reserves, the profitability of applied technologies and the innovative potential determines the main features of the development of technologic strategies of VIOCs. The need to take into account the economic and technological factors in the development of models of strategic development and planning is constantly growing.

The experience of Russian oil and gas companies shows that there are some problems in implementing the technology strategy due to the lack of development of formalized analysis and decision-making tools in the tasks of economic justification and selection of strategic preferences for companies in creation and implementation of new technologies in hydrocarbon production. The practical importance of solving these problems and their insufficient methodological development destined the relevance of the research topic, its purpose, and objectives. Thus, the relevance of the research topic is determined by the need for methodological and instrumental support of integrated estimation and selection of organizational and managerial preferences for technological support of oil and gas projects, taking into account the development of the oil and gas service system.

As one of the consequences of the lack of methodological support for solving this problem, Russian companies are faced with insufficiently motivated and, often, irrational decision-making on the issue of "make or buy" concerning "creation/acquisition" of new technologies. This topic as a whole is so significant and extensive that numerous works of leading scientists, research organizations and companies are devoted to it. The authors can mention some of them (Balakrishnan & Cheng, 2005; McManus, 2003; Daneshgar, Worasinchai, & and Low, 2011; Hung & Low, J. of Information Technology; Schwartz, 2005). Realization of the purpose of this research required the scientific development of the issues of methodological and instrumental support of the strategic analysis of the problem of "creation/acquisition" of new technologies in the oil production of VIOCs.

Some large-scale oil and gas projects are highly specialized and require expert knowledge and professional services. Their implementation includes the stages of conceptual research, feasibility study, design, supply of technological products, and construction (Asrilhanta, Dysonb, & Meadows, 2007; Ban & Hadikusumo, 2017; Salazar-Aramayo, 2013). In the long term, conditions are created when it is not known exactly whether the equipment and hardware to be procured will provide the required volumes and structure of work, how reliably they will function, how difficult it is to provide them with engineering services, which in turn also require modern technologies and technical facilities for servicing. This leads to a restriction in the acquisition and implementation of technological innovations, which is one of the reasons for a slow pace of technological renewal of production using a new technical basis.

When implementing a long-term technological strategy, a whole set of interrelations arises, leading to the need to search for balanced volumes and production efficiency, qualitative and quantitative composition of the equipment park on the basis of new technical equipment. There are questions of increasing the mobility of equipment parks based on the study of the needs and increasing the level of its standardization and unification; organization on a wider scale of experimental operation of new technology. The ability of a large oil and gas project to successfully meet its tasks in accordance with the company's strategic goals depends on the implementation of the project's objectives through portfolio and/or program management through outsourcing (outside the company) or within the company (insourcing). The authors identify a number of management issues among the tasks of project management. They are caused by a new understanding of the links between the stages of technical and economic design and the provision of technical means and equipment that have traditionally been considered separately.

The purpose of the research is to develop methodological support for the subject area of technological management associated with the analysis, integrated estimation and selection of organizational and technologic preferences for implementation of the company's oil and gas projects within the framework of a single process of preparation and decision-making in the creation and implementation of new VIOC technologies.

To achieve this goal, the following main tasks have been accomplished: analysis of directions and issues of implementation of technological strategies of VIOCs; research on the problems of technologic support in the field of hydrocarbon production; analysis of strategic priorities for the development of the oil and gas services market; determining the conditions for investment in the creation and acquisition of new technologies taking into account their potential effect; development of the structure of the decision-making process for estimation and selection of organizational and managerial priorities for technologic support for the implementation of oil and gas projects.

The proposed structure of the decision-making scheme includes a quantitative estimation carried out using a simulation model of accounting for financing conditions for the creation and (or) acquisition of new technologies, and based on the results obtained – the application of matrix tools to the analysis of rational solutions for the selection of a service company (Buliskeria, 2016).

Rational choice of organizational and technologic priorities for the implementation of oil and gas projects is necessary when searching for sources of financing for the creation and (or) acquisition of new technologies and is an important component of the process of commercializing the results of the company's innovation and engineering activities (Talonen & Hakkarainen, 2008). Sources for obtaining funds by a company operating in the field of hydrocarbon production for investment in the project are bank loans, sale of shares, profit for reinvestment.

The technology being evaluated should pay off and give the desired income at the expense of its own return. Therefore, the effect of technology should be determined without involving transactions with securities of both external and own sources of the company. When estimating the effect of technology, it is also necessary to exclude the impact of the external effect of the credit lever believing that the return of own and credit funds is the same and, therefore, the sources of funds are indistinguishable. Therefore, first, as far as possible, the need for capital investments is met at the expense of own funds, and the deficit – at the expense of credit funds. If during production preparation, a deficit balance of the transactions account is appeared (in particular, as a loan servicing debt), it should be changed for the account in the black (i.e., payment of short-term loans on turnover), then adding funds of own savings occurs as far as possible.

When comparing variants of different technologies, it may turn out that the underlying situation in some variants is more adapted to the preparation of production than to the other. Then the liquidation value of surplus capacity should be used as an additional source of financing in the form of revenue. If the estimated technology is not unique for the company, then it is necessary to allocate a share of the basic and turnaround assets related to the technology considered at the time of the analysis. The costs of research and development (R&D) are considered to form the main assets since reimbursement of R&D fund should ultimately be based on the return on capital used in the production of this technology.

It is necessary to separate the actual inflation and the interest on capital. Inflation is convenient to specify as an indexation of costs. A percentage determines the profit of the bank as a return on the credit level of costs. If necessary, one can submit a nominal percentage in the form of the sum of the inflation rate and the actual bank interest. In modeling, it is recommended to express risk in terms of possible deviations of the specified percent types.

The evaluation procedure involves the separation of the financial analysis and the preceding economic analysis; at the stage of economic analysis, the overall need for investments is estimated, and at the stage of financial analysis, the investment structure is selected within the scope of the company's capabilities.

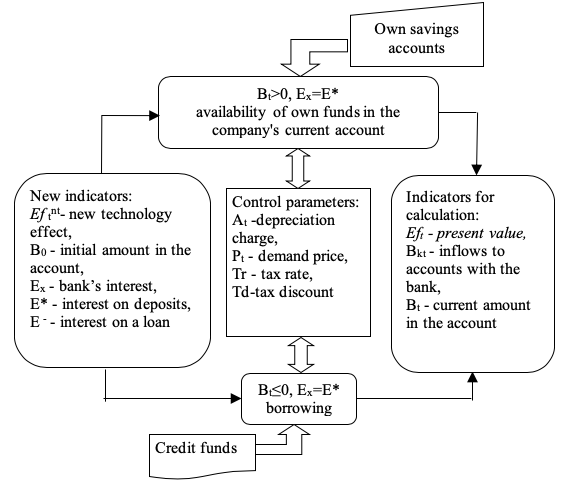

To determine the need for the raising of own and borrowed funds in the implementation of the new technology, a block diagram of the analysis of financing conditions for the new technology and an algorithm for calculating the simulation model are developed taking into account these conditions, Figure 1.

Figure 1

Block diagram of the model analysis of

financing conditions for the new technology

Source: prepared by the authors on the basis of data from Simulation model for analysis

of investment priorities for the implementation of the technological strategy, 2016, by Buliskeria, G.N.

The results show that the benefits of the proposed decision-making structure are to improve the quality of organizational and management decisions based on: providing strategically important information to decision-makers; increasing the validity and flexibility of solutions as a result of an integrated estimation of alternative technological options; increasing the feasibility of organizational and managerial priorities as a result of decomposition and reducing the complexity of the investment decision-making process.

To estimate the effect of technology, a selection criterion is specially formed, when, as a rule, all the distributed income (with the exception of the necessary increase in current assets as the balance of the transactions account) is directed to replenish the accumulation fund. The steady growth of the accumulation fund means that the company successfully copes with all external obligations. The size of the fund determines the amount of the source of funds that can be directed to own consumption and reinvestment (that is, an integral indicator of the effectiveness of the technology at each moment). In the process of curtailing production after full depreciation of fixed assets, this value determines the assets of the company (in terms of the technology under consideration), and after the loan is paid – the amount of accumulated retained earnings or company value (in terms of analysis of this technology as well).

Input data are rates of banking (investment) interest, credit interest, interest on deposits, as well as the volume of capital investments and operating costs included in the project, for example, field development. The purpose of choosing a financing scheme is to ensure the financial feasibility of the project taking into account the desired effect of the technology. Calculation of the desired effect of technology is based on two conditions: availability of own funds on the company's current account and borrowing. The main principle of calculating the criteria for evaluating the effectiveness of the project is the principle of minimizing the deficit balance, i.e. all free funds are sent to repay the debt and pay interest.

Based on the results of calculations with the use of the simulation approach, the need for financing for reaching a given level of the technology effect is determined. This approach implements the selection of priorities for the technologic support of oil and gas projects taking into account decisions regarding the estimation of the effect of technology and financing conditions for the creation and acquisition of new technologies.

Models for evaluating the appropriateness of outsourcing are based on factors that often do not meet the requirements of technology outsourcing (Kumari, 2013). In this regard, the proposed methodology for selecting organizational and technological priorities required the improvement of the matrix approach to the analysis of solutions. To enable the management of the oil and gas company to make decisions on outsourcing, an algorithm showed in Figure 2 is proposed

Figure 2

Algorithm for preparing solutions for the

selection of priorities for technologic support

Source: authors’ elaboration

It combines some strategic and economic estimations facilitating the analysis of strategic risks associated with outsourcing. The algorithm links the maturity of the technology, its relevance now and in the future, and reflects the competitive technological advantages of the company as well.

In order to determine the value of the key competence of the selected service company for the operator company, the matrix is drawn up in Figure 3

Figure 3

Strength of key competencies in

technology relative to competitors

Source: authors’ elaboration

Thus, within the framework of the proposed decision-making structure, the simulation approach makes it possible to evaluate and select alternative technological options for oil and gas projects taking into account strategic objectives, investment conditions, service and engineering support for the creation and use of new technologies.

The advantages of the proposed decision-making structure are to improve the quality of organizational and managerial decisions based on the provision of strategically important information to decision-makers; increase the validity and flexibility of solutions as a result of an integrated estimation of alternative technological options; increase the feasibility of organizational and technological priorities as a result of decomposition and reduce the complexity of the investment decision-making process.

As an object of implementation of the proposed methodology, a project was selected for the development of one of the oil fields of the Volga-Ural oil and gas province. The calculation of the indicators was carried out using the project data taking into account the options for additional development of the fields: zero variant – a variant that assumes the continued development of oil and gas containing facilities by the existing well stock; basic variant – an option approved in addition to the development project; optimized variant – the modified basic version proposed for implementation with the introduction of the technology of dual operation. The basic version of the field development in full is not feasible in the absence of tax incentives. Estimated cash flow calculation was performed provided that 30% of oil was sold for export; 70% – for the domestic market. Given the infrastructure, technologic, resource and economic constraints, a modification of the approved version is proposed for practical use – an optimized version.

Table 1 shows the final results of calculations of indicators and criteria for estimating economic efficiency.

Table 1

Results of calculations based on options for developing the oil field

Indicator |

Option |

||

Base |

Null |

Optimized |

|

Commissioning of wells, pcs. |

787 |

0 |

18 |

Geological and engineering operations (branching, hydraulic fracturing of formation), pcs. |

115 |

0 |

112 |

Oil production, million tons |

16.8 |

4.4 |

11.1 |

Revenues from sales, billion rubles |

258.2 |

61.0 |

165.4 |

Capital investments, billion rubles |

39.2 |

5.6 |

13.7 |

Operational costs (without depreciation charges), billion rubles |

115.4 |

27.8 |

45.9 |

Net present value, billion rubles |

-9.4 |

0.3 |

6.1 |

Profitability index, USD units |

0.5 |

1.1 |

2.9 |

Discounted revenue of the government, billion rubles |

49.7 |

21.7 |

42.3 |

Source: prepared by the authors on the basis of the project

data Investment Efficiency, 2011, by OAO "Udmurtneft"

The choice of the option is carried out in such a way that it has the greatest net present value at an acceptable value of the oil recovery factor.

Further, the authors calculated the effect of technologies of an optimized version that has resource limitations in terms of financing new technology. To implement the required amount of capital investments from own funds, a financing scheme is proposed: 50% of the investment needs to be financed from own retained earnings, 50% of the investment needs to be financed by borrowing. The source of repayment of the loan and interests will be the profit from the sale of the produced oil in the domestic market. According to the calculations carried out, as well as the application of the interest capitalization scheme, this source of repayment of loan obligations is sufficient. The technology of simultaneous-separate operation offered by an optimized version indicates the feasibility of insourcing. In this case, when choosing a service partner, a company with combined technologies is preferable.

Using the simulation model, when evaluating the effectiveness of the field development project, the main recommendations to Russian oil and gas companies on the choice of the strategy for creating and implementing a new technology are formulated:

- to accelerate the rate of commissioning of production capacities for an earlier start of the accumulation process without wasting time on freezing funds;

- to maximize the use of the credit lever (up to the acceptable margin of risk by the ratio of own and borrowed funds);

- to maximally postpone payments in accordance with the legislative requirements in order to increase their depreciation over time (following the idea of discounting);

- to achieve faster indexation of revenue (compared to costs) not to face stable insolvency;

- to revalue obsolete assets or liquidate unfit for future use of funds;

- to use the opportunities of the share capital, short-term investments of free capital in stock.

The proposed decision-making structure contributes to the strategic and economic evaluation and selection of a specific form of technological support for the oil and gas project and its feasibility taking into account the investment conditions for the new technology. It is shown that increasing the efficiency of technological support of oil and gas projects in the field of exploration and production requires the use of an imitative approach to the methodological justification of the estimation and selection of organizational and technologic priorities.

Simultaneously, decisions related to the establishment of organizational and technologic priorities should take into account the specifics of the business environment, such as the level of development of oil and gas services; high risks associated with technological innovation; degree of influence of competitors; features of technological management in companies.

The theoretical significance of the results of the work consists in the scientific substantiation and development of methodological foundations and tools for forecasting and analytical studies to estimate and select the organizational and managerial priorities of technological support for the oil and gas company in the hydrocarbon exploration and production segment. To enhance the effectiveness of ongoing strategic changes in a highly competitive environment, an approach is proposed that requires enhanced interaction and coordination of operational and service activities and is based on the development of new methods for preparing and adopting integrated solutions.

In practice, the results obtained in the work can be used by management and managers of oil and gas and service companies at the stages of developing strategic plans for the economic justification of strategies and programs for technological development and engineering support for oil and gas projects. Verification of the practical feasibility of the conclusions and recommendations made it possible to identify both general and specific approaches to the estimation and selection of organizational and managerial priorities in terms of implementing outsourcing and insourcing functions in the tasks of technological support of oil production taking into account the level of development and organization of oil and gas service and engineering to achieve long-term profitability and sustainable competitive advantage of the company.

Despite a large number of works in the field of organization of oilfield services and technological development of oil and gas industry enterprises, a formalized approach to the estimation and selection of organizational and technological priorities for the implementation of oil and gas investment projects using the technology of "make or buy" decisions for Russian companies has been developed for the first time. The international character of the operating activities of Russian companies (PAO LUKOIL, PAO NK Rosneft, etc.), participation in major joint investment oil and gas projects for the development of hydrocarbon reserves (Iraq, Kazakhstan, etc.) was taken into account when developing the methodology for estimating and selecting organizational and technological priorities, as well as the experience of interaction with leading foreign engineering and service companies (Schlumberger, Halliburton). The effectiveness of this methodology is determined by the level of development of oil and gas services, the quality of engineering services and the innovative potential of oil and gas projects.

The studies have shown that it is very important to maximize and fully realize the potential opportunities to use, first of all, Russian technological and technical developments. As the prevailing form of organization of interaction between VIOCs and service companies, it is recommended to consider insourcing. The modern scientific and engineering potential of Russia makes it possible to guarantee the success of this approach.

The transfer of technology should be considered as one of the promising forms of organization of oilfield services ensuring the growth of efficiency of both the functioning of the supply system of technological products and its development taking into account the requirements for making rational decisions regarding the sources and forms of technological support for oil and gas projects;

The choice of financing schemes that will allow oil and gas companies to ensure the financial feasibility of investment priorities for technological support should be carried out taking into account the given effect of the new technology and the regime of financing of new technologies;

It is recommended to prepare and discuss the organizational and managerial priorities of technological support for large oil and gas projects in accordance with the proposed algorithm for selecting the functions of insourcing and outsourcing in a model for analyzing the financing conditions for a new technology.

Asrilhanta, B., Dysonb, R., & Meadows, M. (2007). On the strategic project management process in the UK upstream oil and gas sector. Omega, 35, pp. 89–103.

Balakrishnan, J., & Cheng, C. (2005). The theory of constraints and the make-or-buy decision: an update and review. Journal of supply chain management: a global review of purchasing & supply, 41(1), pp. 40–47.

Ban, T., & Hadikusumo, B. H. (2017). Culture EPC oil and gas project in Vietnam: grounded theory. International Journal of Energy Sector Management, 11(3), pp. 366–386.

Buliskeria, G. (2016). Simulation model for analysis of investment priorities for the implementation of the technological strategy. Oil, Gas and Business, 11, pp. 50–53.

Daneshgar, F., Worasinchai, L., & and Low, G. (2011). An investigation of ‘build vs. buy’ decision for software acquisition by small to medium enterprises. Information and Software Technology, 55(10), pp. 1741–1750.

Hung, P., & Low, G. (J. of Information Technology). Factors affecting the buy vs build decision in large Australian organization. Journal of Information Technology, 23, pp. 118–131.

Kumari, K. (2013). Outsourcing vs insourcing: best for your organization? International Journal of Management (IJM), 4(4), pp. 65–74.

McManus, D. (2003). A model of organizational innovation: build versus buy in the decision stage. The International Journal of Applied Management and Technology, 1(1), pp. 29–44.

OAO "Udmurtneft". (2011). Investment Efficiency. Additional development program of the Gremikhinskoye deposit for the period of dual production activity. Working draft, 12(1), pp. 1–68.

Salazar-Aramayo, J. (2013). A conceptual model for project management of exploration and production in the oil and gas industry: the case of a Brazilian company. International Journal of Project Management, 31, pp. 589–601.

Schwartz, B. (2005). TedTalk: The Paradox of choice. Получено 12 February 2015 г., из Ted.com: http://www.ted.com/talks/barry_schwartz_on_the_paradox_of_choice

Talonen, T., & Hakkarainen, K. (2008). Strategies for driving R&D and technology development. Research–Technology Management, 5, pp. 54–60.

1. Senior Lecturer, Department of Industrial Management of the Faculty of Economics and Management, Gubkin Russian State University of Oil and Gas (National Research University), Moscow, Russia. Contact e-mail: buliskeriya-gvantza@rambler.ru

2. Professor, Department of Industrial Management of the Faculty of Economics and Management, Gubkin Russian State University of Oil and Gas (National Research University), Moscow, Russia. Contact e-mail: sinelnikov_rgung@mail.ru

3. Professor and Head of Department of Industrial Management of the Faculty of Economics and Management, Gubkin Russian State University of Oil and Gas (National Research University), Moscow, Russia. Contact e-mail: pro_men@list.ru