Vol. 39 (Nº36) Year 2018. Page 19

Vol. 39 (Nº36) Year 2018. Page 19

Tatyana KHUDYAKOVA 1; Andrey SHMIDT 2

Received:20/04/2018 • Approved: 11/05/2018

ABSTRACT: At the present stage of development of the society in the conditions of high variability of the environment it is necessary to reconsider the approaches to management of the enterprises. It is due to the high rate of transformation of the environment under the influence of disturbing factors. The developed approaches should be based on the principles of sustainable development of the enterprises. Moreover, sustainable development should be considered from the perspective of both improving the financial independence of the organization and economic stability. The existence of uncertainty in the external environment requires the use of probabilistic forecasting methods. The authors propose a solution to these problems by building a model of enterprise management based on controlling technologies. The article also offers mathematical tools to improve the quality of enterprise management in a variable environment. The competence of the proposed methods and approaches was tested on the enterprise from the real sector of the economy. |

RESUMEN: En la etapa actual del desarrollo de la sociedad, en condiciones de alta variabilidad ambiental, es necesario revisar los enfoques de gestión empresarial. Esto se debe a la alta tasa de transformación del entorno bajo la influencia de factores perturbadores. Los enfoques desarrollados deberían basarse en los principios del desarrollo empresarial sostenible. El desarrollo sostenible debe verse como un aumento de la independencia financiera de la organización y la estabilidad económica. La existencia de incertidumbre en el entorno externo dicta la necesidad de utilizar métodos de predicción probabilísticos. Los autores de los artículos ofrecen soluciones, designadas como modelos de control basados en tecnologías de control. El artículo también ofrece herramientas matemáticas para mejorar la calidad de la gestión empresarial en un entorno de entorno variable. La elegibilidad de los métodos y enfoques propuestos se prueba con el ejemplo de una empresa del sector real de la economía. |

Today two completely separated methodological approaches to the definition of the sustainability of socio-economic systems are developing. The first one is purely financial, it interprets the "sustainability" from the perspective of independence of the company from borrowed funds basing on the data of the financial statements. In this case, the level of the stability can be assessed by calculating the financial ratios describing the structure of assets and liabilities of the balance of the enterprise at a specific point in time. This approach is widely applicable at present.

If we talk about the first approach, all the authors give almost unambiguous interpretation of the sustainability, it is defined as torque ratio of assets and liabilities. While there is a diversity of approaches in the interpretation of the category "economic stability". A large set of researches are dedicated to the consideration of the category from the position of the return of the enterprise to a certain "point of balance" when there is the effect of disturbances external and internal environment. Scientist this took this property from the theory of technical systems, and it was not rather acceptable for complex, dynamic socio-economic systems. Therefore, in our opinion, much more informative interpretation of the category "enterprise economic sustainability" was given by A. Shmidt and T. Khudyakova (Khudyakova & Shmidt, 2015, 2017, 2018). The wrote that while considering the stability, "it is necessary to take into account the goal-setting in the system of industrial enterprise". It means that stability is interpreted as the probability of entering of the integral indicator of activity of the enterprise into the area of allowable target values (V. Trommsdorff and P. Schneider, 2009). However, in the case when we talk about sustainability of the business entity, then, in our opinion, it is necessary to consider both kinds of stability, financial – as a "measure" of solvency, financial independence (N. Suhaimi & etc., 2016), and economic – as a "measure" of compliance with the actual provisions of the scheme the stated strategic goals. That it why it is necessary to formulate the requirements to the definition of "controlling resistance":

"controlling of stability" is a tool for systematic management with a dynamic character (A. Abelyan, 2013);

the main purpose of controlling stability is the analysis of the current situation and the selection of optimal management decisions, and it is necesary to take into account the resource and other constraints on the minieconomic system while making decisions;

the choice of optimal management decisions should be based on the set of company objectives, on the one hand, and to enhance its financial stability, on the other hand (A. Izotov & O. Rostova, 2017);

the controlling system should be based on scientific methods of modelling and optimization of management processes, including innovative approaches.

Thus, "controlling resistance" is the enterprise management system, which is based on the modern scientific approaches aimed at the improving the sustainable operation and development of minieconomic system, taking into account financial and economic approaches to the definition of sustainability.

Controlling of sustainability implies a close cooperation of all subsystems of the enterprise aimed at the establishment of adequate objectives, taking into account not only the interests of the owners of the company, but also peculiarities of its functioning in conditions of variable environment. This fact once again proves the necessity of an integrated approach to the management of minieconomic system based on the use of controlling as a tool of improving financial-economic sustainability of economic system.

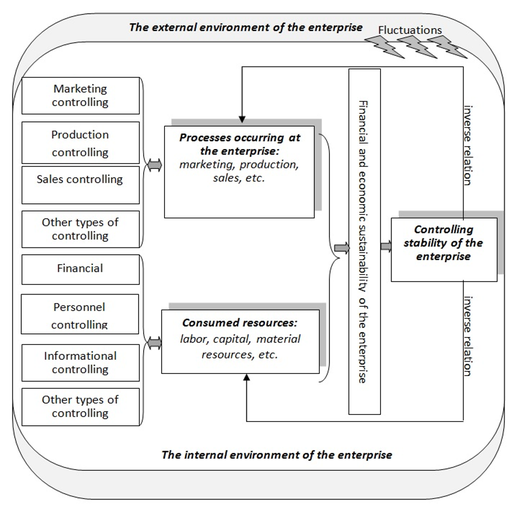

For the successful functioning and development of the minieconomic system it is necessary that the controlling system has affected all areas of the company, taking into account the required resources. In this case, we can distinguish many kinds of controlling, affecting either the processes in the company (controlling of marketing, controlling of production, sales controlling etc) or the resources (financial controlling, personnel controlling, etc) (M. Hauser, 2014; A. Schmidt, 1986; B. Becker & etc, 2010). However, these processes and resources also have a direct impact on the sustainability of the enterprise, which in its turn necessitates the development of controlling system stability of an enterprise (Figure 1).

Figure 1

Functional diagram of the controlling

system of stability of an enterprise

*compiled by the author

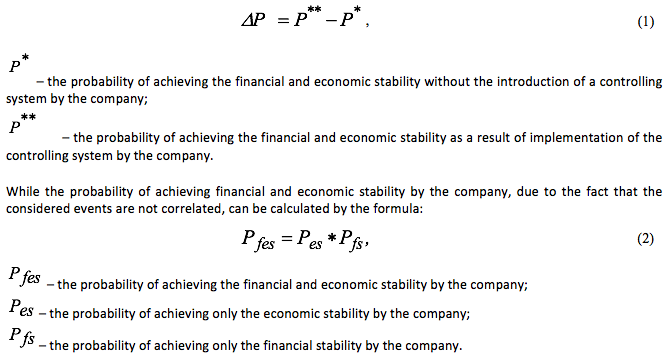

The fact that the events are not interconnected, you can prove it with a simple example. Functioning in the conditions of global crisis, the enterprise in the short term may not reach the regulatory level of financial stability in the connection with the deterioration of the general economic situation in the country. However, at the same time it can be quite economically stable, as the target can be increasing the value of the cash flow or the non-receipt of loss in the reporting period. It is clear that, ideally, both conditions, which are reflected in the integral indicator (the probability of achieving financial and economic stability by the company), should be observed.

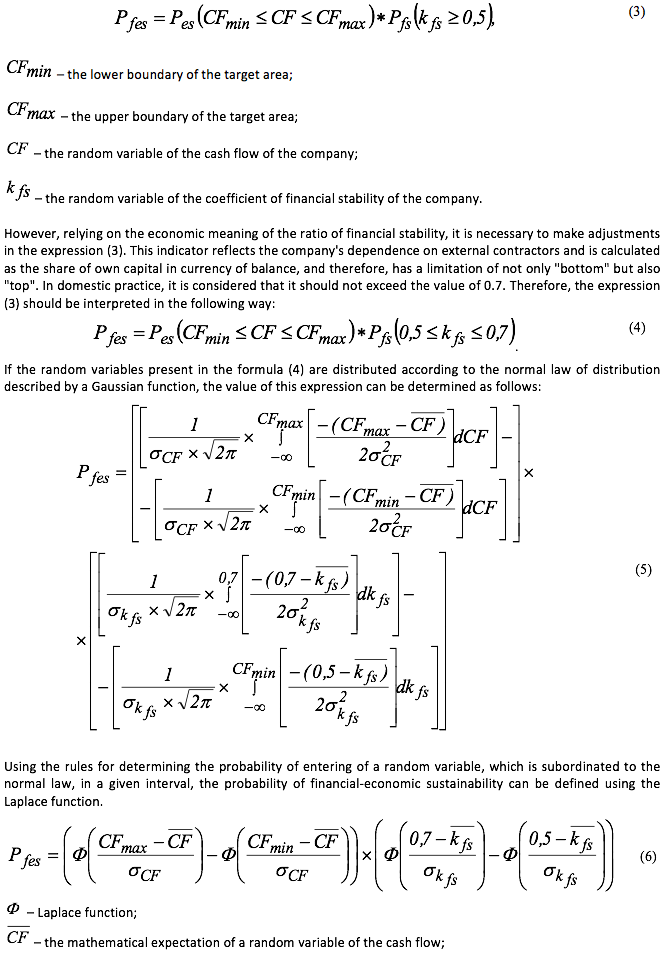

However, while determining the probability of both financial and economic sustainability it is necessary to take into account the imposed on the stability condition constraints. In the assessing the economic sustainability it is necessary to rely on the interpretation of the term, which implies that the economic entity operates stably, if the result indicator of its activity falls in the target area. The probability of achieving the company the financial stability, which can be expressed, for example, through the use of the coefficient of financial stability, should take into account the constraints on data rate.

If the resulting indicator of activity of the enterprise is understood as its cash flow, then the expression (2) can be represented as follows:

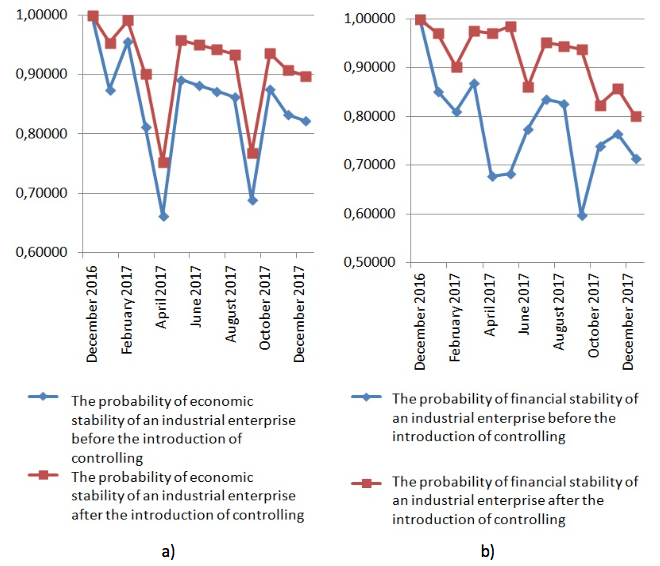

Basing on the above proposed approach we defined the probability of achieving various types of stability for the example of industrial enterprises of the Chelyabinsk region (Figure 2, 3).

Figure 2

Changes in the dynamics of (a) economic and (b) financial stustainability

as a result of controlling the implementation of the system

We can distinguish several periods with apparent lack of the stability – April 2017 and September 2017. From the figures it is seen, lack of what type of stability is inherent for enterprise at a particular point in time.

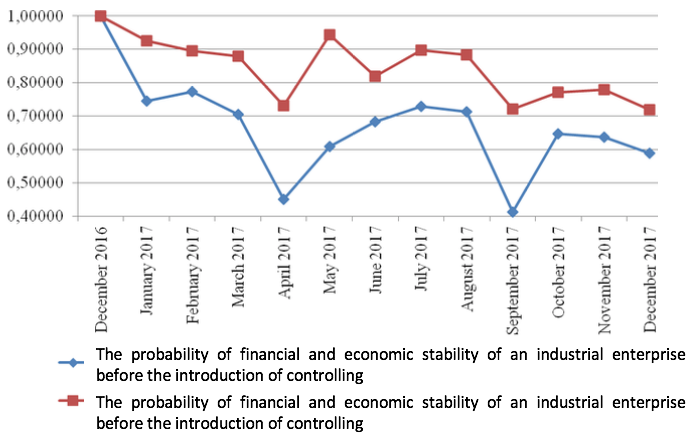

Thus, the need to implement proactive management actions at the enterprise arises. These effects can imply either a return to the stage of "goal setting" in case of impossibility of achievement of previously set goals or adjustment of the production process with the objective of anticipating of the possible disturbances (Figure 2, 3). After that it is necessary to reanalyze the probability of achieving financial and economic stability.

Based on the obtained information we determined the level of financial and economic sustainability of the enterprise after the implementation of the controlling system (Figure 2, 3), which also showed a significant increase as a result of the implementation of controlling measures, a probability level of sustainable functioning stopped falling below 0.71869, although before the implementation of the system of controlling the value of the probability of stable functioning fell to 0.41136 (September 2017). Thus, the increase in probability is about 30%.

Figure 3

Changes in the dynamics of financial and economic stability

as a result of controlling the implementation of the system

Acceptable values of the degree of the probability of achieving any type of controlling in the minieconomic system are set for each enterprise individually and depend on the degree of riskiness of the business owner.

It is clear that the increase in the probability of financial and economic stability will testify about the increase of effectiveness of controlling system stability introduced in the enterprise. However, for a more detailed analysis it is possible to use factor models and development of economic and mathematical simulation models that would improve the quality of the system controlling the sustainability at the enterprise that is especially important in the conditions of variable environment. The presence of environmental variability not only determines the necessity of formation of methodological approaches to creation of system of controlling of sustainability at the enterprise, but also dictates the requirements for the development of tools for assessment, prediction and management of this system, which should be based on probabilistic and statistical approaches.

It once again proves the necessity of an integrated approach to the management of the enterprise basing on the use of controlling as a tool of improving financial-economic sustainability of socio-economic system.

South Ural State University is grateful for financial support of the Ministry of Education and Science of the Russian Federation (grant No 26.9677.2017/ВР (Number for publication: 26.9677.2017/8.9)).

The work was supported by Act 211 Government of the Russian Federation, contract № 02.A03.21.0011.

Abelyan, A.S. (2013). Building a system of structural dynamic stability of the enterprise in terms of modernization. Scientific review, (6), pp. 178–183.

Becker, B., Balttser, B., Goncharov, L. (2010). The interaction management and controlling: the experience of Germany and Russia. Controlling, (36), pp. 20–30.

Izotov, A.V., Rostova, O.V. (2017). The use of principal component analysis in the assessment of the investment climate regions. Economic, financial and management problems of the manufacture, (38), pp. 82–85.

Hauser M. (2014). Controlling – a purposeful planning and management of the company, URL: http://news.tut.by/economics/116110.html (reference date: 01.08.2017).

Khudyakova, T.A., Shmidt, A.V. (2015). Theoretical approaches to the essence and economic sustainability evaluation of industrial enterprises. Proceedings of the 26th International Business Information Management Association Conference – Innovation Management and Sustainable Economic Competitive Advantage: From Regional Development to Global Growth, IBIMA 2015, pp. 1626–1634.

Khudyakova, T.A., Shmidt, A.V. (2017). Improving the efficiency of the enterprise's activity based on the implementation of the controlling system. Proceedings of the 12th International Conference on Strategic Management and its Support by Information Systems, SMSIS 2017, pp. 46–52.

Khudyakova, T.A., Shmidt, A.V. (2018). Methodical approaches to managing the sustainability of enterprises in a variable economy. Revista Espacios. Vol 39, 2018, 13. Retrieved from: http://revistaespacios.com/a18v39n13/18391328.html.

Schmidt, A. (1986). Das Controlling als Instrument zur Koordination der Unternehmungstuhrung. – Frankfurt, 1986.

Suhaimi, N., Nawawi, A., Salin, A. (2016). Impact of enterprise resource planning on management control system and accountants' role. International Journal of Economics and Management, 2016, 10(1), pp. 93–108.

Trommsdorff, V., Schneider, P. (2009). Grundzuge des betrieblichen Innovations managements. – Munchen.

1. South Ural State University, High School of Economics and Management, khudiakovata@susu.ru

2. South Ural State University, High School of Economics and Management, shmidtav@susu.ru