Vol. 39 (Number 26) Year 2018 • Page 31

Janaína Cássia GROSSI 1; Pedro Paulo Melo ARANTES 2; Eunice Henriques Pereira VILELA 3; Kárem Cristina de Sousa RIBEIRO 4; Luciano Ferreira CARVALHO 5

Received: 08/02/2018 • Approved: 12/03/2018

ABSTRACT: Considering The Efficient-Market Hypothesis (EMH) and a recent Brazilian corruption scandal involving the company JBS and politicians, this study aimed to analyze whether the disclosure of the scandal abnormally affected the stock pricing of Brazilian companies that operate in the American market by issuing ADRs. The results show a loss of value on the day after the event and a cumulative post-event loss, which opposes the EMF; abnormal returns were found and there was not a rapid adjustment of prices. |

RESUMO: Considerando a Hipótese do Mercado Eficiente (HME) e um recente escândalo de corrupção brasileiro envolvendo a empresa JBS e políticos, este estudo tem como objetivo analisar se a divulgação do escândalo afetou de forma anormal o preço das ações das empresas brasileiras que operam no mercado americano através da emissão de ADRs . Os resultados mostram uma perda de valor no dia seguinte ao evento e uma perda cumulativa pós-evento, o que se opõe a HME; retornos anormais foram encontrados e não houve um ajuste rápido dos preços. |

Fama (1991), author of The Efficient-Market Hypothesis (EMH), states that the behavior of stock prices follows a random walk, so it is not possible for agents to create mechanisms for obtaining abnormal profits in determined periods of time. If the behavior of asset prices follows a random path, it is natural that their variation is unpredictable (Forti et al., 2009).

Fama (1970) also defined three forms of market efficiency, and according to the semi-strong form no investor is able to obtain abnormal returns based on any publicly available information. Any new information would be quickly incorporated into asset prices, making it impossible for investors to use the information for abnormal returns.

However, some recent national and international research utilizes event studies to verify the existence of abnormal returns around the date of an announcement of a relevant fact (Silva, 2013; Camargo & Barbosa, 2015; Lewis, O’Donovan & Willett, 2015).

Carvalho, Malaquias and Ribeiro (2009) for example, pointed after empirical tests the inefficiency of the market, as significant abnormal returns of the stock prices of companies that compose the Corporate Governance Index were detected in days before and after the disclosure of Quarterly Information and Annual Information. The results found in these studies can be interpreted as market inefficiency, once in the semi-strong form of efficient market, an abnormal return is expected only on the date of the announcement.

Taking this into consideration, it is also possible to infer that the disclosure of public information about companies and governments involved in corporate crimes or corruption scandals could affect the economy and the financial market, causing abnormal returns.

The studies of Porta, Lopez-de-Silanes, Shleifer and Vishny (1998) and Lee and Ng (2006) analyzed the effects of corruption on the market value of firms and suggested that high levels of corruption in the public sector have significant influence on the share price of publicly traded companies. Taruel (2017) showed that news involving corruptive practices affected the Brazilian exchange market (BM&FBovespa) in terms of volatility.

A recent Brazilian case of corruption involved the company JBS - the global leader in animal protein processing - and politicians. On the 17th of May of 2017 the Brazilian newspaper O Globo disclosed details about the plea bargain testimony of Joesley and Wesley Batista, respectively the chairman and chief executive of the meat company JBS, that provided evidence against prominent politicians involved in corruption and details of illegal campaign contributions to congressmen, senators and governors. Mr. Batista also recorded a conversation that he had with the president of Brazil - Michel Temer - that indicates involvement of the president in corruption acts (The New York Times, 2017).

Considering the possibility of announcements of relevant facts cause abnormal return in the stock market, what is the relation between corporate and government scandals occurred in Brazil and the behavior of stock prices of Brazilian companies traded in the American exchange market? The aim of this study is to analyze how the disclosure of the involvement of the company JBS and Brazilian politicians in corruption affected the stock pricing of Brazilian companies that operate in the American stock market by issuing ADRs.

The methodology adopted was the event study and for that, the period from November 12th, 2016 to May 22nd, 2017 was analyzed, the event window considered 11 days (-5 to +5). The sample consisted of 29 Brazilian companies that are traded in the New York Stock Exchange. The data were collected in Economatica database in a daily frequency.

The study is organized as follows. Section 2 provides a review about Efficient-Market Hypothesis, references to prior research that used event study to analyze stock price behavior and a narrative about JBS’s case. Section 3 describes event study methodology that was used to obtain the results. Section 4 presents and discusses the results. Finally, there is a conclusion with a summary of the findings.

The Efficient-Market Hypothesis (EMH) was proposed by Fama in 1970 and represents one of the pillars of support for the Modern Finance Theory (Forti, Peixoto & Santiago, 2009). Several studies based on this theory to study the behavior of capital markets in Brazil (Belo & Brasil, 2006; Fama, 1991; Gallo & Famá, 1998; Perobelli & Ness Jr., 2000; Ceretta & da Costa Jr., 2001).

Fama (1970, p. 2) defined an efficient market as “market in which prices provide accurate signals for resource allocation: firms can make production-investment decisions, and investors can choose among the securities that represent ownership of firm’s activities under the assumption that security prices at any time “fully reflect” all available information.”

In disagreement with Efficient-Market Theory, over the past years researchers have been interested in developing procedures for predicting stock prices. However, Fama (1991) states that the stock prices behavior follows the so-called random walk, so it is not possible for agents to create mechanisms for obtaining abnormal profits in predetermined periods of time. Forti et al. (2009), argue that if the behavior of asset prices follows a random path, it is natural that their variation is unpredictable.

The forms of market efficiency were defined by Roberts (1967) and Fama (1970) as Weak Form; Semi-Strong Form and Strong form. Table 1 summarizes the three forms:

Table 1

Forms of Market Efficiency

Forms of market efficiency |

Information |

Description |

Weak Form |

Prices of the Past |

No investor can get abnormal returns through the analysis of past prices. The information contained in past prices is not useful or relevant in obtaining extraordinary returns. |

Semi-Strong Form |

Public Information |

No investor is able to obtain abnormal returns based on any publicly available information. Any new information would be quickly incorporated into asset prices, making it impossible for investors to use the information for abnormal returns. |

Strong Form |

Private Information |

No investor can get abnormal returns using any kind of information, even confidential information, which is not public knowledge. |

According to Fama (1970), the semi-efficient form of publicly available information must already be reflected in the share price. Thus prices do not just reflect past history, but also all publicly available information. In this way, no investor can obtain abnormal returns based on publicly available information, as prices quickly adjust to the disclosure of new information.

French and Roll (1986) make clear that public information is one that becomes known at the same time as it affects prices. Damodaran (2002) argues that the possible reactions of the market to new information would be: immediate confirmation of the hypothesis of semi-strong efficiency; slow additional returns to investors after the announcement and exaggerated instant reaction with later correction.

As it is expected in an efficient market, there is a rapid adjustment of prices after the announcement of a fact, if the reaction is slow, investors can get extraordinary negative or positive returns by buying or selling their stocks on the date of the disclosure. However, Carvalho, Malaquias and Ribeiro (2009) argue about the possibility of using event studies to verify the existence of abnormal returns around the date of an announcement of a relevant fact. According to the authors, abnormal return in days prior to the date of the announcement may characterize information leakage, while abnormal return in days after the date of the event characterize delayed market reaction to the announcement. Both situations can be interpreted as market inefficiency, once in the semi-strong form of efficient market, an abnormal return is expected only on the date of the announcement.

After empirical tests, Carvalho, Malaquias and Ribeiro (2009) pointed the inefficiency of the market, as significant abnormal returns of the stock prices of companies that compose the Corporate Governance Index were detected in days before and after the disclosure of Quarterly Information and Annual Information.

Other event studies also point out abnormal returns related to social events: Silva (2013) compared stock market performance before and after the announcement of the inclusion of companies in the Corporate Sustainability Index, the results showed that on average the market positively evaluated the sustainability efforts and was willing to repay for that.

Gabrovšek, Aleksovski, Mozetič and Grčar (2017) provided an in-depth analysis of Twitter volume and sentiment about companies in the Dow Jones Index focusing on Earnings Announcements, the authors show that on the day of the announcement the collective opinion of the users reflect the stock movement and there was abnormal high return of 2-4%.

Camargo and Barbosa (2015) used the event study methodology and analyzed the behavior of stock prices of traded Brazilian companies on the day after the announcements of mergers and acquisitions (M & As). The result showed that the announcement contained relevant information to the pricing of shares, possible use of inside information and that semi-strong form of efficiency occurred in the Brazilian market.

In recent years other social events like corruption, environmental and social responsibility, ethical behavior and scandals have been systematically studied and covered by the literature and various means of communication. These events may change the investor's perception of the company's image and reliability, affecting their investment decision and expected return.

Lewis, O’Donovan and Willett (2015) for example, investigated the impact of environmental activism on a large corporation in Australia; they demonstrated that the involvement of the company in legal cases against activists played a significant decline of the market value of the company in a long term.

In Brazil for example, a study carried out by Fundação Dom Cabral (2015) found that only 15.5% of the internationalized companies analyzed did not have their internationalization strategies affected by the political and economic crisis experienced in Brazil. Some of these companies have American Depositary Receipts traded on the New York Stock Exchange (NYSE). This fact allows us to reflect about the impact of events such as political crises, corruption scandals and corporate crimes involving Brazilian companies and their stock prices in the American exchange market.

The studies of Porta, Lopez-de-Silanes, Shleifer and Vishny (1998) and Lee and Ng (2006) analyzed the effects of corruption on the market value of firms and suggested that high levels of corruption in the public sector have significant influence on the share price of publicly traded companies.

Kimura, Basso and Krauter (2006) discuss how the Behavioral Finance decreases the gap between decision-making practices and traditionally accepted models based on the Modern Finance Theory. The authors found that personal gains and risk aversion have more impact on the choices made than the investment risk, which demonstrates non-rational behavior. In this way, it can be argued that investors would be affected in a non-rational way regarding the information disclosed and scandals involving companies and their countries.

Székely and Knirsch (2005) discuss how social behavior leads the investor’s decision, since they are concerned about socio-environmental issues and seek alternatives that are more similar to their inclinations, opposing the idea of a rational market and Modern Finance Theories. These prospects support the idea that investors are oriented much more than by mere financial indicator, caring for image, trust and values.

Gusmão and Garcias (2008) defined the Depositary Receipt (DR) as securities issued by foreign banks and traded in an environment outside its domestic market. In this context, ADRs are receipts of companies from other countries that are transacted in the United States, issued by an American commercial bank known as Custodian Bank (Matsumoto, 1995)

According to Rodrigues et al. (1999) the issuance of ADR’s benefits investors because they have fairer prices, lower risk and more transparent information revealed by the greater number of investors and the more rigorous accounting standards; The issuing companies are benefited because they expand their alternatives to obtain resources at lower cost, the financial evaluation of the company is better and less susceptible to fluctuations.

Camargos and Barbosa (2007) affirm that ADRs are used by Brazilian companies to expand their liquidity center, improve the confidence of the national investor and to become known worldwide. Bruni (2002) highlights the rapid evolution of the number of ADRs issued by Brazilian companies, and their increasing importance for the financing strategies of these companies.

Gusmão and Garcias (2008) conclude that the pricing of Brazilian ADRs in U.S dollar is strongly related to the stock prices in the Brazilian exchange market BM&FBovespa. According to the authors, informational asymmetry exists between Brazilian and American investors: U.S investors dealing with ADRs do not have as fast access to information as Brazilian investors, so some events may have a different impact on the prices in the Brazilian market and in the U.S market.

The Brazilian company JBS is part of the J&F Investimentos - Holding group created by the brothers Joesley and Wesley Batista. The company started its operations in 1953 as a small butcher’s shop and it is now the global leader in animal protein processing.

J&F Investimentos Group is present in over 30 countries and its portfolio is comprised of companies in the areas of animal proteins processing, footwear and clothing, dairy products, personal care and cleaning products, pulp production mill, agribusiness and retail banking sector and energy generation and distribution. In 2016 it had revenues of 170 billion reais ($49 billion), 240 thousand employees worldwide, more than 220 production facilities and the company exported products for 150 countries (JBS Investimentos, 2017).

According to The New York Times (2017), on May 17th the Brazilian newspaper O Globo reported that the brothers Joesley and Wesley Batista, respectively the chairman and chief executive of the meat company JBS, signed plea bargains agreeing to provide evidence against prominent politicians involved in corruption and details of illegal campaign contributions to congressmen, senators and governors.

As part of the plea bargain, Joesley Batista recorded on March 7th one of his conversations with Michel Temer – President of Brazil – when the president endorsed the executive’s payment of hush money to the former speaker of Brazil’s lower house of Congress, who has been serving since 2016 a 15-year sentence for his role in the Petrobras corruption scandal. During the conversation, Michel Temer also told to Joesley Batista to pay a lawmaker from his party to help resolve a problem in a J&F’s power plant. After that the Federal Police filmed the lawmaker receiving money (The New York Times, 2017).

As a result of the plea bargain the Federal Police filmed the receipt of money and arrested politicians and people involved in the accusation. The Federal Supreme Court started an investigation against the President Michel Temer and removed two congressmen from office (Folha de São Paulo, 2017).

The present study uses event study methodology to verify the impact of the testimony of Mr. Joesley Batista against Brazilian politicians involved in corruption cases on stocks prices of Brazilian companies that operate in the American stock market by issuing ADRs.

According to Camargos and Barbosa (2003), this approach consists of analyzing the impact of announcement on stock prices behavior. This research aims to find weather abnormal returns occurred in the period studied, checking the impact of the announcement in the days following the disclosure of the information.

An event study is based on the following steps: definition of the event; selection criteria; determination of normal and abnormal returns; estimation procedure; test procedure and empirical results.

The event studied was disclosed on the 17th of May of 2017 by the Brazilian newspaper O Globo some days after the testimony of Mr. Batista - which was part of plea bargain - that provided evidence against prominent politicians involved in corruption and details of illegal campaign contributions to congressmen, senators and governors. Mr. Batista also recorded a conversation with the president of Brazil Michel Temer that indicates his involvement in corruption acts.

Data used in this study were obtained from the Economatica database. Indexes of the American exchange market were also used, where the companies studied have their shares. The sample consists of 29 Brazilian companies that issue ADRs on the American exchange and have their financial data available in the Economatica software.

For the determination of normal and abnormal returns, the returns calculated in the event window are compared with the normal return to verify the existence of abnormal returns. For the calculation of the return the study uses the logarithmic form (continuous capitalization), according to the Equation 1:

(1)

(1)

R = return;

Ln = natural logarithm

Pt = share value in period t

This form of calculation was chosen due to the statistical consequence to the frequency distribution of the returns. In the logarithmic form the distribution tends to be normal resembling a normal curve, which is more suitable for parametric statistical tests.

To determine the normal returns, the return model adjusted to the risk and the market was chosen. This model is also known as Single Index Model. It is one of the statistical models that relates linearly the return of a certain financial asset with the return of the market portfolio following linearity specifications (linearity, stationarity, serial independence of residues in relation to market return and stability of variance of residues) (Camargos & Barbosa, 2003)

For the estimation procedure step, the estimation window, the event window and the comparison window were defined. The estimation window is used as base for the calculation of the normal return; this study utilizes 120 days before the event window as estimation window. The period of the event window is not included in the estimation window so it will not influence the result.

For the event window it was defined a period of 11 days: 5 days before the event, the day of the event and 5 days after the event. The choice for analyzing 5 days before the event is justified by the possible leakage of information and comparability of the results

For the significance test two methods were used: a parametric test (Test t) and a non-parametric test (Wilcoxon Test). The value of Test t can be obtained by dividing the average abnormal return and the standard error, according to Equation 2:

(2)

(2)

Non-parametric tests are assumption-free about the distribution of returns. According to Campbell, Lo and Mackinlay (1997), characteristically these tests are not used in isolation, but together with parametric ones. The Wilcoxon test is based on the idea that the sum of the levels above and below average samples should be analogous.

For the study, closing prices were collected in the Economatica database. The calculation of the returns was performed in software Excel 2010. And for the study of events it was used the Stata software version 13.

For the selection of the sample it was found that 54 Brazilian companies issued ADRs on the American stock exchanges during period studied. Of the 54 companies 29 had its stock pricing available in the Economatica database, so the sample considers the 29 companies. All of the 29 companies are present on the New York Stock Exchange (NSYE).

Using the proposed methodology with event window of 11 days (-5 to +5), the average return for each day, the accumulated value of the companies in the sample and the significance value of the data were calculated. The results are represented in Table 2:

Table 2

Abnormal returns of the event window of the Brazilian sample

Days |

Abnormal Return on Avarage |

P-Value |

Acumulated |

-5 |

0,0052541 |

0,327 |

0,0052541 |

-4 |

0,0081540 |

0,053 |

0,0134081 |

-3 |

0,0195683 |

0 |

0,0329764 |

-2 |

0,0017830 |

0,594 |

0,0347594 |

-1 |

0,0099834 |

0,029 |

0,0447428 |

0 |

-0,0024667 |

0,489 |

0,0422761 |

1 |

-0,1593333 |

0 |

-0,1170572 |

2 |

0,0402402 |

0 |

-0,0768170 |

3 |

-0,0273071 |

0,001 |

-0,1041241 |

4 |

0,0175770 |

0 |

-0,0865471 |

5 |

0,0086187 |

0,033 |

-0,0779284 |

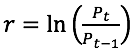

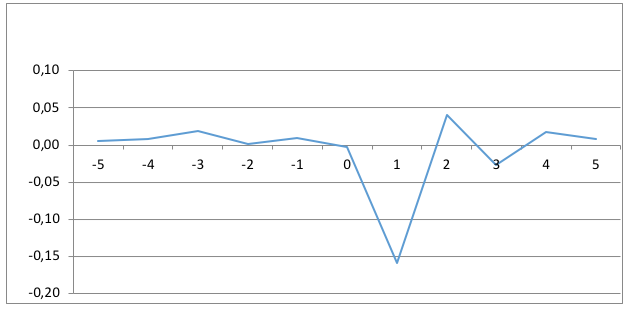

As shown in table 3, the return on the date of the event (day 0) is not significant, this fact is due to the time of information disclosure: the stock market had already closed the activities of the day. However, there was large loss of stock value on the day after the announcement, on average 16%. Such evidence can be seen well in Figure 1 and Figure 2:

Figure 1

Average abnormal returns for the Brazilian sample

-----

Figure 2

Average accumulated abnormal returns for the Brazilian sample

It is possible to see through Figure 1 and 2 that after the event the market reacted strongly to the impact caused by the testimony of Mr. Batista giving details about the involvement of the president Michel Temer and other Brazilian politicians in a corruption scandal. The news about the testimony caused mistrust of the American market in relation to Brazil and consequently to the Brazilian companies active in the American stock market. On the second day after the announcement of the testimony the recovery rate was lower than the devaluation rate, indicating that the situation affected significantly the Brazilian companies operating in the United States.

The results are in agreement with the studies of Camargo and Barbosa (2015); Lewis, et (2015) and Gabrovšek, et al (2017), that showed that the stock market responds to announcements in the same way that the political crisis in Brazil affects the foreign investor's view about Brazilian companies.

To confirm the results the same analysis was made for an American sample of companies in the same period, the sample was selected according to the sales volume. It was selected the 5 companies with the highest volume of sales in the month of April and the 5 companies close to the average.

Applying the same methodology used for the companies from the Brazilian sample, the results in Table 3 were obtained for the American companies:

Table 3

Abnormal Returns to the Event Window of the American Sample

Days |

Abnormal Return on Avarage |

P-Value |

Acumulated |

-5 |

0,0003070 |

0,883 |

0,0003070 |

-4 |

-0,0000918 |

0,97 |

0,0002152 |

-3 |

-0,0045288 |

0,203 |

-0,0043136 |

-2 |

-0,0030885 |

0,207 |

-0,0074021 |

-1 |

-0,0056011 |

0,174 |

-0,0130032 |

0 |

-0,0008842 |

0,854 |

-0,0138874 |

1 |

0,0021819 |

0,301 |

-0,0117055 |

2 |

0,0012431 |

0,555 |

-0,0104624 |

3 |

-0,0040779 |

0,051 |

-0,0145403 |

4 |

0,0046330 |

0,022 |

-0,0099073 |

5 |

0,0036309 |

0,262 |

-0,0062764 |

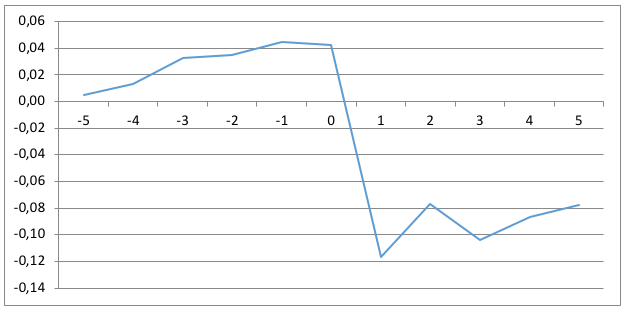

Analyzing Table 5, it can be noted that for the sample selected there is no change in stock price or even significance, which shows that only Brazilian companies were affected by the event. Figure 3 (using the same scale as Figure 1) shows the change in the value of American stocks. Note that there is no fluctuation in the value over the analyzed period.

Figure 3

Average abnormal returns for the American sample

So it is possible to confirm that the New York Stock Exchange itself was not so affected by the event, but only the Brazilian companies that operate there. When evaluating the NYSE index, it was noted that on the date of the event there was a 1.5% drop but after 4 trading days it reached again the value it had before, what did not occur for the Brazilian companies.

Finally, it is estimated that the return of companies diverges significantly in the Brazilian sample studied. Some companies during the 5 days lost 25% of the value of the shares – por example Gol - but others had a minimum loss around 1%, like Vale. The returns are presented in Table 4:

Tabela 4

Logarithmic return of Brazilian companies in the days after the event

| Company | 1 |

2 |

3 |

4 |

5 |

Acumulated loss |

ABEV |

-0,13193 |

0,035975 |

-0,00531 |

0,022828 |

-0,00348 |

-0,081917175 |

BBDO |

-0,17774 |

0,063775 |

-0,02202 |

0,01476 |

0,031253 |

-0,089970583 |

BBD |

-0,21102 |

0,0492 |

-0,04185 |

0,01695 |

0,011933 |

-0,174780207 |

LND |

-0,16527 |

0,073601 |

-0,03104 |

0,013793 |

0,008186 |

-0,100730272 |

BAK |

-0,06572 |

0,024962 |

-0,0124 |

0,049706 |

-0,00895 |

-0,012404029 |

BRFS |

-0,10964 |

0,033042 |

0,059908 |

0,021946 |

0,020742 |

0,025994855 |

CIG_C |

-0,19958 |

0,053843 |

-0,09289 |

0,026202 |

0,046324 |

-0,166107134 |

CIG |

-0,26633 |

0,04588 |

-0,0412 |

0,041196 |

0,030907 |

-0,189541812 |

ELP |

-0,1882 |

0,064775 |

-0,04601 |

0,03291 |

0,031861 |

-0,104663497 |

CZZ |

-0,17689 |

0,086273 |

-0,03587 |

0,008392 |

0,012457 |

-0,105635582 |

CPL |

-0,07939 |

0,036414 |

-0,00945 |

0,003793 |

0,000946 |

-0,047694013 |

ERJ |

-0,03513 |

0,011312 |

0,051668 |

-0,00766 |

0,026054 |

0,046246535 |

FBR |

0,030013 |

0,057452 |

0,060918 |

-0,00094 |

-0,00565 |

0,141794278 |

GFA |

-0,19383 |

0,050112 |

-0,08401 |

-0,00866 |

0,015816 |

-0,220572426 |

GGB |

-0,18892 |

0,085119 |

-0,02105 |

0,051825 |

-0,02385 |

-0,09687632 |

GOL |

-0,28247 |

0,058024 |

-0,10681 |

0,00995 |

0,067852 |

-0,253461472 |

ITUB |

-0,20476 |

0,062639 |

-0,02988 |

0,021567 |

0,01107 |

-0,139362992 |

OIBR_C |

-0,18485 |

0,111226 |

-0,01368 |

0,038823 |

0,003306 |

-0,045169001 |

CBD |

-0,19862 |

0,071317 |

-0,03999 |

0,049501 |

0,010831 |

-0,106951755 |

PBR |

-0,18407 |

0,045112 |

-0,02889 |

0,014832 |

0,02847 |

-0,124547751 |

PBR_A |

-0,23942 |

0,071724 |

-0,0266 |

0,01339 |

0,030955 |

-0,149955002 |

SBS |

-0,17381 |

0,04566 |

-0,05457 |

0,039771 |

0,023797 |

-0,119150736 |

BSBR |

-0,19967 |

0,064193 |

-0,02426 |

0,035846 |

-0,00385 |

-0,127730524 |

SID |

-0,22 |

0,094834 |

0 |

0,014185 |

-0,01418 |

-0,125163233 |

VIV |

-0,11753 |

0,055367 |

-0,02222 |

0,00542 |

-0,00036 |

-0,079321467 |

TSU |

-0,15477 |

0,046026 |

-0,00974 |

0,013879 |

0,013689 |

-0,090912663 |

UGP |

-0,1181 |

0,049907 |

-0,00268 |

0,022144 |

0,000876 |

-0,047851977 |

VALE |

-0,06657 |

0,052419 |

0,009456 |

0,016336 |

-0,02224 |

-0,010594578 |

VALE_P |

-0,07306 |

0,056863 |

0,0162 |

0,00984 |

-0,02478 |

-0,014944288 |

NYSE |

0,000921 |

0,009456 |

0,003677 |

0,001674 |

0,00143 |

0,017158335 |

This study aimed to analyze how the disclosure of the involvement of the company JBS and Brazilian politicians in corruption affected the stock pricing of Brazilian companies that operate in the American stock market by issuing ADRs. According to the results, there was a considerable loss of value on the day after the event (on average 15%). Five days after the event there was a cumulative post-event loss of 12%. The study opposes the Efficient-Market Hypothesis (Fama, 1970), since abnormal returns were found and there was not a rapid adjustment of prices after the announcement of the fact.

There were companies that had higher impact than others, indicating that the sectors of performance, prior trust and image of these companies may affect the reliability of the investor and could mitigate the impact that the current Brazilian political scenario may have on them.

This study confirmed the idea of the work of Kimura et al (2006), that argues about how behavior may change the investment decision. Besides the country and the business scenario were the same, the impact among the companies was different, signaling social and feeling aspects (behavior), in which the investor feels secure or trust more in certain companies than in others, despite the scenario involved by all companies being the same. It can still be said that there is a strong relationship between a country's image, particularly the political scenario and its companies return.

This article hopes to contribute to the overall vision that in a nation the acts of its representatives and the image the country affect companies’ value. It is necessary a strong action to prevent scandals and acts of corruption, providing transparency to the foreign investor in order to gain confidence and thereby make international investment more viable.

As a proposal for future research, it is possible to investigate qualitatively the difference between the companies studied in this article to exalt the determinants that differentiated the companies regarding the impact of the event. It is also possible to evaluate whether financial indicators had also weight in the impact that the companies suffered.

Belo, N. M., & Brasil, H. G. (2006). Assimetria informacional e eficiência semiforte do mercado. Revista de Administração de Empresas, 46(SPE), 48-57.

Bruni, A. L. (2002). Globalização financeira, eficiência informacional e custo de capital: uma análise das emissões de ADRs brasileiros no período 1992-2001 (Doctoral dissertation, Universidade de São Paulo).

Campbell, J. Y., Lo, A. W. C., & MacKinlay, A. C. (1997). The econometrics of financial markets. princeton University press.

Ceretta, P. S., & da Costa Jr, N. C. (2001). Particularidades do mercado financeiro latino-americano. Revista de Administração de Empresas, 41(2), 72-77.

Damodaran, A., Avaliação de Investimentos: ferramentas e técnicas para determinação do valor de qualquer ativo. Rio de Janeiro: Qualitymark, 1ª . edition, 4ª . reprint, 2002.

De Camargos, M. A. D., & Barbosa, F. V. (2003). Teoria e evidência da eficiência informacional do mercado de capitais brasileiro. Caderno de Pesquisas em Administração, 10(1).

De Camargos, M. A., & Barbosa, F. V. (2015). Eficiência informacional do mercado de capitais brasileiro em anúncios de fusões e aquisições. Production, 25(3), 571-584.

De Camargos, M. A., & Barbosa, F. V. (2007). Emissão de ADRs, Retorno Acionário Anormal e o Comportamento das Ações no Mercado Doméstico: Evidências Empíricas. ENANPAD. Anais... ANPAD, Rio de Janeiro.

Fama, E. F. (1970). Efficient Capital Markets: A review of theory and empirical works. The Journal of Finance. v. 25, n. 2, p. 383-417, may 1970.

Fama, E. F. (1970). Multiperiod consumption-investment decisions. The American Economic Review, 163-174.

Fama, E. F. (1991). Efficient capital markets: II. The journal of finance, 46(5), 1575-1617.

FDC, Fundação Dom Cabral. Ranking FDC das multinacionais brasileiras 2015. Disponível em: http://www.fdc.org.br/blogespacodialogo/Lists/Postagens/Post.aspx?ID=451 Acesso em: 06/07/2017

Folha de São Paulo (2017). An Ever-Healthy Skepticism. [online] Available at: http://www1.folha.uol.com.br/internacional/en/ombudsman/2017/05/1886246-an-ever-healthy-skepticism.shtml

Forti, C. A. B., Peixoto, F. M., & de Paulo Santiago, W. (2009). Hipótese da eficiência de mercado: um estudo exploratório no mercado de capitais brasileiro. Gestão & Regionalidade (Online), 25(75).

French, K. R., & Roll, R. (1986). Stock return variances: The arrival of information and the reaction of traders. Journal of financial economics, 17(1), 5-26.

Gabrovšek P, Aleksovski D, Mozetič I, Grčar M (2017) Twitter sentiment around the Earnings Announcement events. PLoS ONE 12(2): e0173151. https://doi.org/10.1371/journal.pone.0173151.

Gusmão, I. B., & Garcias, P. M. (2008). Análise dos custos de transação, das oportunidades de arbitragem e da eficiência de mercado nas empresas brasileiras emissoras de ADR. In Congresso USP de Controladoria e Contabilidade (Vol. 5, pp. 125-141).

JBS Investimentos. Quem somos. 2017. Available at: <http://jfinvest.com.br/quem-somos/apresentacao/ >. Accessed 05 jul. 2017.

Kimura, H., Basso, L. F. C., & Krauter, E. (2006). Paradoxos em finanças: teoria moderna versus finanças comportamentais. Revista de Administração de Empresas, 46(1), 41-58.

Lee, C. M. C., & Ng, D. (2006). Corruption and international valuation: Does virtue pay?. Available at SSRN 934468.

Lewis, R, O'Donovan, G, & Willett, R. (2015), 'The effects of environmental activism on the long-run market value of a company: a case study', Journal of Business Ethics, 128 (4) pp. 1-22

Matsumoto, A. S. (1995). A emissão de ADRs: American Depositary Receipts pelas empresas da América do Sul e a teoria de mercado eficiente (Doctoral dissertation).

Perobelli, F. F. C., & Ness Jr, W. L. (2000). Reações do mercado acionário a variações inesperadas nos lucros das empresas: um estudo sobre a eficiência informacional no mercado brasileiro. XXIV ENANPAD, 24º, Anais... Florianópolis: ANPAD.

Porta, R. L., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. W. (1998). Law and finance. Journal of political economy, 106(6), 1113-1155.

Rodrigues, E. L., Ramos, P. B., & Barbosa, A. P. (1999). Maior Visibilidade ou integração do mercado de capitais brasileiro? Os efeitos da listagem de ações de empresas brasileiras no mercado norte-americano através do mecanismo de recibos de depósitos de ações. Revista Eletrônica de Administração, 5(1).

Székely, F., & Knirsch, M. (2005). Responsible leadership and corporate social responsibility:: Metrics for sustainable performance. European Management Journal, 23(6), 628-647.

Silva, M. Á. D. (2013). O índice de sustentabilidade empresarial e a percepção do investidor: um estudo das empresas entrantes no índice nos anos de 2011 a 2013. (Mastering dissertation in Ciências Cont. Atuariais) - Pontifícia Universidade Católica de São Paulo, São Paulo.

Teruel, R. L. H. (2017). Corrupção no Brasil: comportamento do mercado acionário à divulgação de notícias de práticas corruptivas.

1. Student of the postgraduate program in Finance, Faculty of Management and Business, Universidade Federal de Uberlândia, Uberlândia, Brazil. janainagrossi_3@hotmail.com

2. Student of the postgraduate program in Finance, Faculty of Management and Business, Universidade Federal de Uberlândia, Uberlândia, Brazil

3. Student of the postgraduate program in Finance, Faculty of Management and Business, Universidade Federal de Uberlândia, Uberlândia, Brazil

4. Professor of the postgraduate program in Finance, Faculty of Management and Business, Universidade Federal de Uberlândia, Uberlândia, Brazil

5. Professor of the Faculty of Management and Business, Universidade Federal de Uberlândia, Uberlândia, Brazil