Vol. 38 (Nº 49) Year 2017. Page 12

Elvira A. RUSETSKAYA 1; Mikhail G. RUSETSKIY 2; Irina A. BELOZEROVA 3; Petr V. CHEREPOV 4; Dmitrii S. VORONOV 5

Received: 12/06/2017 • Approved: 05/07/2017

2. Dynamics Of Extraordinary Situations In Russia And Abroad

3. Analysis Of Factors Restraining Development Of Insurance In Russia

4. Offers On Improving Marketing Strategy Of Insurers

5. Revealing Problems When Moving To Interrelations Marketing

ABSTRACT: In the world practice, the main mechanism of protection from various unfavorable incidents that cause considerable material loss is the insurance that has not been yet developed well in Russia. The main reasons that slowdown the development of the Russian insurance market include low level of the population’s income subject to high prices for insurance services, insufficient economic competence of the population, high level of mutual mistrust between insurants and insurance companies, and the main thing, the Russian “just in case it won’t happen” (maybe nothing will happen to me!!!). However, the Russian insurance market has a powerful potential. In order to popularize the insurance mechanism in the system of protecting property interests of various subjects, it is necessary to choose the optimal marketing strategies that allow revealing potential consumers who are peculiar of their own tastes, wishes, needs, and motivation for buying. To achieve the research goal, it is necessary to consider prospects of developing the Russian insurance market by improving the system of insurance marketing. The work considers problems and perspectives of insurance companies’ moving from the selling marketing to interrelations marketing that will contribute to the possibility to form long-term and mutually advantageous relations with clients, and, as a consequence, further development of the insurance market. |

RESUMEN: En la práctica mundial, el principal mecanismo de protección contra diversos incidentes desfavorables que causan considerable pérdida de material es el seguro que aún no se ha desarrollado bien en Rusia. Las principales razones por las que la desaceleración del desarrollo del mercado de seguros ruso incluyen el bajo nivel de los ingresos de la población sujetos a los altos precios de los servicios de seguros, la escasa competencia económica de la población, el alto nivel de desconfianza mutua entre insurants y compañías de seguros, y lo principal, el ruso "por si acaso no sucederá" (¡ tal vez nada me ocurrirá!). Sin embargo, el mercado de seguros ruso tiene un potencial poderoso. Para popularizar el mecanismo del seguro en el sistema de protección de los intereses de la propiedad de diversos temas, es necesario elegir las estrategias de marketing óptimas que permitan revelar a los consumidores potenciales que son peculiares de sus propios gustos, deseos, necesidades, y la motivación para la compra. Para lograr el objetivo de investigación, es necesario considerar las perspectivas de desarrollar el mercado de seguros ruso mejorando el sistema de mercadeo de seguros. El trabajo considera problemas y perspectivas de las compañías de seguros que se trasladan de la comercialización de ventas a interrelaciones de marketing que contribuirá a la posibilidad de formar relaciones de largo plazo y mutuamente ventajosas con los clientes, y, como consecuencia , desarrollo adicional del mercado de seguros. |

The statistics of man-caused and natural incidents and catastrophes that have occurred in Russia over the recent 15-20 years shows that their consequences become more and more dangerous for objects of economy, population and natural environment. Today the direct and indirect losses from them make up 4-5% of the gross national product.

According to the data of insurance organizations, the global economic loss only from natural hazards made up USD 40 bln. in the 1960s. In the 1980s this indicator grew up to 120 bln. In the first part of the 1990s the annual loss from natural hazards exceeded this indicator for the 1960s more than 10 times, and the total losses for the 1990s reached USD 400 bln. According to the estimations of the Ministry of Emergency Situations of Russia, now the loss from natural hazards many times exceeds the possibilities of the world community on providing injured people with humanitarian assistance. This problem has acquired the global nature.

According to the experts, the annual economic loss (direct and indirect) from extraordinary situations is 1.5–2% from GDP, which restrains the social and economic development of the country and its regions (Kotlobovskiy and Bardin 2011).

According to the statistics, 25% of the Russian territory is within the zone of seismic activity. Thus, the population of this part of the country (i.e. about 20 mln. persons) faces danger because of the threat of earthquakes measuring Force 7 and more.

During the period of successful growth of the Russian economy and improvement of the population’s life, as well as in the context of the crisis, it is necessary to pay much attention to the factors that support economic safety of citizens, economic entities, and the state. The main area of the safety system is the development of a set of measures that can compensate for the material loss caused by various unfavorable incidents. One of the forms to counteract such threats is insurance.

In the modern world, as statistical data show, the number of natural, man-caused, and ecological hazards is constantly growing. In the authors’ opinion, the state economy has a serious threat related to considerable expenses used to liquidate consequences of natural disasters, accidents and catastrophes. They are covered at the expense of budgetary funds of citizens and legal entities.

Table 1 considers the dynamics of emergency situations in the Russian Federation over the recent 10 years.

Table 1

Dynamics of Emergency Situations in the Russian Federation for 2007-2016

Indicators

Years |

Total number of emergency situations (ES)

|

Including |

|||||

Number of ES |

Died as a result of ES, persons |

Suffered as a result of ES, persons |

Number of man-caused ES |

Number of natural ES |

Number of biological and social ES |

Large terroristic acts |

|

2007 |

2,693 |

5,199 |

27335 |

2,248 |

402 |

43 |

- |

2008 |

2154 |

4,491 |

3756 |

1,966 |

152 |

36 |

- |

2009 |

425 |

734 |

2428 |

270 |

133 |

21 |

- |

2010 |

360 |

683 |

2,908 |

178 |

118 |

43 |

21 |

2011 |

297 |

791 |

23,716 |

185 |

65 |

42 |

5 |

2012 |

434 |

819 |

95,105 |

228 |

148 |

56 |

5 |

2013 |

335 |

620 |

211,540 |

166 |

116 |

46 |

7 |

2014 |

262 |

567 |

129,869 |

186 |

44 |

31 |

1 |

2015 |

257 |

699 |

20,784 |

179 |

45 |

33 |

0 |

2016 |

298 |

789 |

130,938 |

177 |

54 |

67 |

1 |

Source: Compiled by the authors according to the statistics of

the Ministry of Emergency Situations of the Russian Federation

Having analyzed the data about the emergency situations in the Russian Federation for 2016, it is possible to see that most of all people suffered from natural catastrophes – 126,465 persons (96.6%), from man-caused emergency situations – 3,970 persons (3.0%), from biological and social emergency situations – 503 (0.4%), and from terroristic acts – 21 persons (0.01%).

According to the opinion of the independent expert and estimation Expert Alliance company (Date of the Expert Alliance Independent Expert and Estimation Company), the main types of citizens’ property losses include fires and illegal actions of third parties (robberies, thefts, and plunders). Let’s consider the situation related to fires in 90 countries of the world where 4.6 bln. persons, i.e. almost 3/4 of all population of the planet, live (Brushlinskiy and Sokolov 2008) (Tables 2 and 3).

Table 2

Economic and Statistical Estimations of Losses as a result of Fires

No. |

Number of fires per year |

Number of countries |

Countries |

1 |

1.6 - 1.7 mln. |

1 |

the USA |

2 |

from 100 thous. to 600 thous. |

10 |

Great Britain, France, Russia, Poland, China, India, Brazil, Italy, Mexico, Australia. |

3 |

from 20 thous. to 65 thous. |

25 |

Japan, Indonesia, Turkey, Canada, RSA, Malaysia, the Netherlands, Ukraine, Spain, Iran. |

4 |

From 10 thous. to 20 thous. |

20 |

Thailand, Algeria, Uzbekistan, Romania, Kazakhstan, Cuba, the Czech Republic, Belgium, Serbia, Denmark, Finland. |

5 |

From 5 thous. to 10 thous. |

15 |

Iraq, Sri-Lanka, Syria, Slovakia, Georgia, Singapore, Croatia. |

In total |

71 |

Other 150 countries have, as a rule, considerably less than 5 thous. fires per year. |

|

Source: Fire Service Committee

According to the data of the Ministry of Emergency Situations of the Russian Federation, in 2016 Russia suffered from 139,703 fires, the direct material loss of which made up RUB 14,323,829 thous.

Table 3

Average Number of People Who Died in Fires per Year, in Countries of the World

Group No. |

Number of fire victims per year |

Number of countries |

Countries |

1 |

Above 10 thous. |

1 |

Russia |

2 |

From 4 thous. to 10 thous. |

1 |

India |

3 |

From 1 thous. to 4 thous. |

5 |

The USA, China, Byelorussia, Ukraine, RSA, Japan |

4 |

From 0.2 thous. to 4 thous. |

20 |

Great Britain, Germany, Indonesia, Brazil, Mexico, Turkey, Iran, Korea, Spain, Poland, Canada, Uzbekistan, Romania, Kazakhstan, Lithuania, Latvia, the Philippines |

5 |

From 0.1 thous. to 0.2 thous. |

13 |

Australia, Sri-Lanka, the Czech Republic, Hungary, Sweden, Bulgaria, Moldova |

In total |

40 |

The remaining 180 countries have, as a rule, less than 100 victims (from 0 to several dozens of persons per year) |

|

Source: Fire Statistics Center (FSC) of the International

Technical Committee on Preventing and Fighting Fires

Many of the above-mentioned reasons of the great material loss incurred to citizens and the state are risks subject to insuring. In many countries it acts as the most efficient tool to compensate the potential loss to the population and economic entities (Rusetskaya and Anohina 2012).

However, analyzing the national insurance market, it is possible to show numerous reasons that restrain its development.

It is possible to refer the intersystem factors (staff qualification, level of potential, quality of selling insurance products, incompliance with the global standards of requirements to the payment capacity) and the factors caused by the peculiarities of the Russian economy development (level of the company’s and citizens’ payment capacity, regulatory base and legislation, monopolization of insurance companies, unfair competition) to the factors that restrain the development of Russian insurance.

The conducted researches show that the population massively did not get used to solving their financial problems by applying to official financial institutes. Russian citizens impose the responsibility for solving various problems mainly on themselves (Table 4), and only 3% of the responders were ready to buy an insurance (Table 5).

Table 4

Whom Russians Rely on When Solving Various Everyday Problems

Only on themselves, % |

Problem |

On the state assistance, % |

64,8 |

Lack of money for articles of daily necessity |

20.4 |

44,4 |

Lack of money for articles of long-term necessity |

9.9 |

39,8 |

Diseases, health problems |

30.1 |

34,2 |

Employment |

18.7 |

30,8 |

Housing problems |

18.6 |

30,1 |

Childcare |

13.8 |

Source: ZIRCON research group

-----

Table 5

Guarantees of Affluent Old Age

What is it necessary to do to ensure affluent old age, to your mind? |

% |

To have a well-paid job |

46 |

To have savings |

40 |

To have income from property |

30 |

To provide children with good education and opportunity to earn good money |

22 |

To buy an insurance, to become a member of non-state Pension Fund |

3 |

Source: ZIRCON research group

The analysis of the tendencies related to forming the insurance market, studying its peculiarities and prospects of further development showed that the national insurance market had a powerful potential. A special condition of its development is to understand and stimulate insurance as a specialized area on stabilizing economy. Reliable and stable economic environment required for the economic growth is formed by creating an efficient system of insurance protection of the individuals’ and legal entities’ property interests. However, constraint of consumers to buy insurance services is not always an efficient method of promoting them. More often the intention of potential insurants to use insurers’ services is caused by the own estimation of the level of threat of every certain risk, and potential loss related to it.

In September 2015, researchers of the Sociology Institute of the Russian Academy of Sciences conducted a special all-national sociological research on revealing the phobia and threats existing in the Russians’ mass consciousness (Fig. 1). This research showed that about 70% of the responders suffered at least one situation of the anxiety and unprotectedness.

Figure 1

When Russians Feel Fear, Anxiety and Unprotectedness Most Often, %

Source: Informational and Analytical Bulletin of the

Sociology Institute of the Russian Academy of Sciences

Analyzing the general picture of the threats according to the Public Opinion (Table 6), Russian citizens mainly trouble about those risks that cannot be insured. In particular, these are such troubles as anxiety related to the high price of medical services, concerns about relatives, and poverty fear.

Table 6

Sensibility of Population to Certain Dangers

Danger |

Share of population that is sensible to dangers, % |

High price of medicines and medical service, problems related to bad health |

16 |

Concern about relatives |

15 |

Poverty, growth of prices, salary non-payment |

14 |

Unemployment |

12 |

Changes to worse |

5 |

Instability, indefiniteness, despair |

5 |

Banditism, theft, hooliganism |

3 |

Famine |

2 |

Impossibility to provide children with education, high price of education |

2 |

Housing and everyday problems |

2 |

Old age and death threat |

2 |

Natural hazards, catastrophes, fires |

2 |

Powerlessness, lawlessness, tyranny |

2 |

Bad relations in the family |

1 |

Loneliness |

1 |

Economic decay |

1 |

Inflation, default |

1 |

Organized crime, terrorism |

1 |

Drug addiction, excessive drinking |

1 |

Power weakness, threat of political upheaval |

1 |

Army |

1 |

Source: Public Opinion Fund

Nevertheless, it is impossible to state that citizens do not trouble about the insured dangers.

What factors do have an impact on the population’s need in the insurance institute as an efficient way to fight dangers? (Table 7).

Table 7

Population’s Sensibility to Risks In Terms of Property Groups

|

Self-estimation of the income level |

|||||

Risks |

In total for the population |

We hardly have money for food |

We eat well and can purchase articles of daily necessity |

We can buy major appliances but not a new car |

I can buy a car but not a flat |

I can buy a flat or a new house

|

|

Share of population that is sensible to risks, % |

|||||

Car accident |

41.2 |

40.3 |

45.1 |

49.2 |

55.2 |

46.7 |

Fire |

36.0 |

46.5 |

41.5 |

36.1 |

31.1 |

27.0 |

House robbery |

35.5 |

46.5 |

40.5 |

35.3 |

31.7 |

31.9 |

Flat water damage |

28.9 |

38.4 |

32.9 |

27.6 |

26.8 |

22.5 |

Terroristic acts |

28.1 |

36.8 |

31.6 |

27.9 |

23.1 |

21.7 |

Traumas |

26.7 |

34.3 |

30.6 |

26.1 |

25.1 |

19.4 |

Banditism |

25.8 |

37.5 |

28.3 |

23.5 |

21.2 |

14.5 |

Infectional diseases |

23.9 |

32.5 |

26.5 |

22.5 |

21.8 |

17.1 |

Natural hazards |

23.6 |

31.0 |

27.1 |

22.2 |

22.5 |

17.8 |

Intoxication |

18.7 |

27.3 |

20.7 |

16.3 |

14.4 |

9.8 |

other |

2.5 |

3.2 |

2.9 |

1.7 |

1.6 |

3.6 |

I am not afraid of anything |

7.4 |

10.6 |

6.4 |

5.6 |

7.0 |

14.6 |

I cannot say |

3.9 |

4.5 |

3.7 |

3.2 |

3.5 |

3.4 |

Sensibility index |

2.9 |

3.7 |

3.3 |

2.9 |

2.7 |

2.3 |

Source: Rosgosstrah Strategic Researches Center

The level of welfare is the most obvious and influential condition that defines the use of insurance and opportunity to acquire it. The basic goal for the person is to survive – to provide oneself with the minimum level of welfare that is enough for supporting stable existence. In this context, of course, the demand for insurance is almost equal to zero (Table 8) (Baykov, Zhirnihin, Zubets and Smirnova 2007).

Table 8

Impact of the Income Level on the Decision about Buying an Insurance Service

Moving the needs stairs (bottom upwards) |

Values |

Peculiar level of income |

Peculiarities of the customer conduct |

Aptitude to buying insurance |

1. Self-fulfillment – favorite business, family, hobbies, providing long-term stability and protection |

Above USD 1.000 per family member monthly |

Focus on combining quality and status nature of goods and services |

There is a need in full insurance protection |

|

2. Socialization – occupying a decent position in the society, obtaining public respect from social surrounding |

USD 150-1000 per family member monthly |

Branded cheap goods and services focused on showing social status |

Interest in insurance is weak, obligatory or cheap insurance products are bought |

|

3. Survival – food, clothes, shelter |

Up to 150 per family member monthly |

Unbranded products (goods and services) from the low price category. Focus on utilitarian value of products |

No interest in insurance |

Consequently, in order to provide protection by applying insurance mechanisms, it is necessary to pay special attention to developing insurance products that comply with the citizens’ and legal entities’ needs and financial possibilities (Rusetskaya and Shahbiev 2011).

Now one of the vivid tendencies is the emergency of the insurance market’s interest in marketing and establishing marketing departments in insurance companies. Along with this, the majority of Russian insurance companies use marketing as a tool to expand the existing products (insurance services) sales. It means that the offer for consumers is formed at random without taking into account the market requirements and consumers’ needs (Kozel 2012b). The use of marketing in insurance companies is limited mainly to applying the aggressive policy of promoting through strengthening advertising, public relations, developing chains of selling insurance products and stimulating them. However, as the practice shows, these marketing efforts do not bring the desired result, and the expenses of insurance companies for marketing, to be more exact, for one of the components of the marketing mix do not bring the expected advantages (Kozel 2012a). Thus, according to the data of the Federal Service of State Statistics, in 2015 insurers concluded 144.7 mln. of agreements. This is 8.4% less than in 2014. At the same time, the number of agreements on voluntary insurance decreased by 9.0%, and that on obligatory insurance – by 6.7% (Data of the Statistics of Russian Ministry of Emergency Situations; Data of the Federal Service of State Statistics).

The above statistics says that insurance companies insufficiently use the existing potential of marketing possibilities and apply few marketing tools, what is more, not the most efficient ones. It decreases their work efficiency. Along with this, it is necessary to use marketing as the most important element of marketing relations. It will contribute to stable development of enterprises regardless of the area of activity. Thus, now insurance companies get an objective need in reconsidering the attitude to issues related to marketing management in the sector.

It is necessary to start managing marketing in the area of insurance services from the correct selection of approaches (concept) to marketing activity. Now in the practice of marketing management insurance companies apply the empiric-marketing concept. It aims at forming the consumers’ feeling of the need in buying insurance services. In order to form the consumers’ feelings that will consequently transform into the payable demand, managers of insurance companies form the feelings conductors in their consumers’ consciousness, and actively apply advertising, public relations, verbal and non-verbal communication means (Manuilenko, Mishchenko, et al. 2015).

According to the authors of the article, in the modern context insurance companies must apply the partnership relations concept, the main principle of which is the focus on forming long-term loyalty of consumers based on close interrelation when developing values and, being based on it, on obtaining both the consumer’s advantage and company’s profit (Aleshina 2006).

The figure shows the scheme of insurance companies’ interrelation with consumers when applying the relations marketing concept (Fig. 2).

Thus, using the interrelations marketing in insurance companies assumes the development of the concept related to the consumer value priority as a result of close interrelation between the company and the client.

Figure 2. Marketing of Interrelations in Insurance Companies

Such interrelation results in the joint use of the obtained advantages. For buyers this is complete meeting of their needs, and for insurance companies these are high incomes and loyal clients.

In order to solve the task related to forming the partnership relations concept, it is necessary to study the clients’ values system based on market researches, segmenting insurance market, and company positioning. In addition to studying the values system peculiar of clients, using marketing, insurance companies must create and develop a new system of values in the customers’ consciousness by communication outreach of the usefulness, advantage, perceived value of insurance importance in the consumers’ consciousness (Rusetskaya, Kozel and Rusetskiy 2013).

To more efficiently cooperate with consumers, insurance companies must deliver values to the client by establishing a branched chain of insurance companies’ subdivisions, creating a high level of clients’ awareness about insurance products.

The main tool related to the interrelation of insurance companies with consumers is services customization, i.e. individualized approach to creating services based on the clients’ needs and requests. The main condition of applying the partnership relations concept in insurance companies is the need to move from the market and product management of marketing to managing the process of values creation. At the same time, all members of the company must take part in this process.

Applying the interrelations marketing concept in insurance companies assumes the formation of long-term, trustworthy, and efficient relations with clients. In this context, all marketing solutions must aim at maintaining the existing consumers and attracting new ones. In the modern context for insurance companies it is cheaper several times to maintain the existing clients than to attract a new one. At the same time, it is necessary to understand that clients are not equal. It is necessary to pay more attention to some part of the clients database because this attitude is compensated by buyers’ adequate actions, while other buyers can take away many resources of the company without due compensation. It is important to form the optimal clients’ database of the company. Optimal work with the clients’ database of the business assumes defining of the clients’ values during the whole life cycle or life as a client. In this connection, it becomes urgent for insurance companies to establish relations with clients to form loyalty. It is possible to display the scheme of evolution of relations with consumers as loyalty stairs or succession of evolutionary phases of the development of relations with customers (Fig. 3) (Aleshina 2006).

Applying the concept of marketing related to interrelations with clients in insurance companies will contribute to forming long-term relations with customers when buyers move up the loyalty stairs from potential buyers to the adherent who not only regularly buys the service but also recommends it to others.

Figure 3

Customers’ Loyalty Ladder

In spite of considerable expenses, it is advantageous for insurance companies to apply the concept of partnership relations marketing because it assumes the formation of the consumers’ readiness to continue the cooperation with the company. It allows to considerably decrease the expenses for promoting services. It will provide long-term growth and income of insurance companies. A lot of authors think that the growth of the consumer loyalty to the company providing services will contribute to its competitiveness growth.

However, when moving to the interrelations marketing, not only financial but also psychological problems may arise. Thus, for example, the head of the insurance company, as well as the marketing director may be interested in the current position of the insurance company in terms of applying the marketing concept. In other words, it is necessary to analyze the level of interrelations marketing development on the “empiric marketing – interrelations marketing” platform.

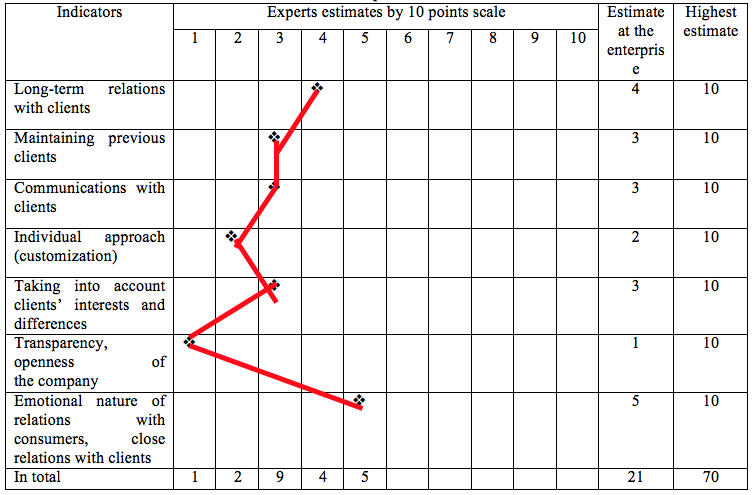

In order to reveal problems when moving to interrelations marketing, the authors of the article developed a questionnaire for the head and specialists of several insurance companies in the city of Stavropol. It offered to estimate the interrelations marketing features by using the 10 points scale. The results of the poll were analyzed, generalized and shown in the table.

Table 9

Researching Features of Interrelations Marketing in Insurance Companies

The following features that characterize the level of interrelations marketing development in insurance companies were singled out: long-term relations with clients, maintaining the previous clients, communications with clients, individual approach to the clients’ needs (customization of services), transparency and openness of companies, and emotional nature of relations with clients.

Thus, the conducted estimation of the level of interrelations marketing development in insurance companies in the city of Stavropol showed that companies established their relations with clients not efficiently enough, they pursued a passive policy of attracting and maintaining the previous clients. Thus, according to experts, such loyalty factor as long-term relations with clients that is the basic indicator of interrelations marketing was estimated by 4 points out of 10.

The poll showed that out of 70 points insurance companies could score only 21 points.

It is necessary to note that the conducted research of the level of interrelations marketing development in insurance companies was a sort of conditional because the experts’ opinions agreement and veracity of expert opinions were not estimated. Nevertheless, the obtained results are rather vivid and vibrant.

Thus, in order to improve the efficiency of work with clients and to increase competitiveness when insuring catastrophic risks, insurance companies must essentially reconsider methods and approaches to using the marketing concept. It is necessary to actively implement principles of interrelations marketing in the activity of insurance companies. Such marketing must be based on creating computer databases that accumulate information about products, price and communicational preferences of clients, and peculiarities of their life style. This information can be collected by digital mail out, registration on websites, and processing clients’ data. It enables insurance companies to collect specific information about consumers, form an individual portrait of every loyal and potential client, and, being based on the existing information, to form an individually oriented marketing mix.

The conducted research allows making the conclusions that marketing plays an important role on the insurance market, forms a certain image of the company, and increases its attractiveness. However, to achieve efficient results, it is always necessary to find the optimal combination of all components of the marketing policy: price formation, estimation of competitors, advertising, product, preferences of consumers, etc. Tendencies of the modern insurance market make companies permanently change, and marketing as a system that manages the activity on the market can help it.

The authors confirm that the above data do not contain the conflict of interests.

Aleshina I.V. (2006). Povedenie potrebiteley [Consumers’ Behavior]: Textbook. Moscow: Economist.

Baykov S.V., Zhirnihin A.S., Zubets A.N. and Smirnova K.A. (2007). Potrebitelskoe povedenie na finansovyh rynkah Rossii [Consumer Behavior on Russian Financial Markets]. Moscow: Economy.

Brushlinskiy N.N. and Sokolov S.V. (2008). Mirovaya statistika i analiz pozharov [Global Statistics and Analysis of Fires]. Date View May 13, 2017 http://www-faza.at.ua/load/1-1-0-2.

Dannye Federalnoy sluzhby gosudarstvennoy statistiki [Data of the Federal Service of State Statistics]. Date View May 13, 2017 http://www.gks.ru/free_doc/new_site/finans/strah-org.htm.

Dannye nezavisimoy ekspertno-otsenochnoy kompanii Ekspert-Alyans [Date of the Expert Alliance Independent Expert and Estimation Company]. Date View May 13, 2017 http://expert-alyans.ru/.

Dannye statistiki MChS RF [Data of the Statistics of Russian Ministry of Emergency Situations]. Date View May 13, 2017 http://www.mchs.gov.ru/folder/33160904

Kotlobovskiy I. B. and Bardin I. Yu. (2011). Effektivnoe vzaimodeystvie gosudarstva i strahovogo rynka v vozmeschenii i preduprezhdenii uscherba ot prirodnyh i tehnogennyh katastrof [Efficient Interrelation of the State and Insurance Market in Compensating and Preventing Loss from Natural and Technogenic Catastrophes]. Materials of the International Insurance Fund “Interrelation of the State and Insurance Organizations Problems and Perspectives of Development”. Perm. 2011.

Kozel I.V. (2012a). Osobennosti analiza konkurentosposobnosti predpriyatiya sfery uslug [Peculiarities of Analysis of Competitiveness of the Enterprise Providing Services]. SciencePark, 4, 31-39.

Kozel I.V. (2012b). Formirovanie konkurentnyh preimuschestv predpriyatiya na osnove monitoringa ego konkurentosposobnosti [Forming Competitive Advantages of the Enterprise Based on Monitoring Its Competitiveness]. Kant, 3, 86-88.

Manuilenko V. V. Mishchenko A. A. et al. (2015). A Comprehensive Definition of the Concept of Innovation in Russian and International Science. International Journal of Economics and Financial Issues, 5(4), 1029 – 1037.

Rusetskaya E.A. and Anohina O.A. (2012). Formirovanie modeli sovremennoy zaschity v imuschestvennom strahovanii katastroficheskih riskov [Forming the Model of Modern Protection in Property Insurance of Catastrophic Risks]. Finances and Credit, 46(526), 36-42.

Rusetskaya E.A. and Shahbiev M.T. (2011). Problemy realizatsii strahovogo mehanizma pri obespechenii ekonomicheskoy bezopasnosti grazhdan [Problems of Implementing the Insurance Mechanism When Providing Economic Safety of Citizens]. Financial Business, 3(152), 54-62.

Rusetskaya E.A., Kozel I.V. and Rusetskiy M.G. (2013). Kastomizatsiya uslug strahovaniya kak napravlenie formirovaniya partnerskih otnosheniy s potrebitelyami [Customization of Insurance Services as an Area of Forming Partnership Relations with Consumers]. Insurance Business, 10(247), 56-62.

1. North Caucasus Federal University (NCFU), 355009, Russia, Stavropol, Pushkina street, 1. E-mail: elwirasgu@mail.ru

2. North Caucasus Federal University (NCFU), 355009, Russia, Stavropol, Pushkina street, 1.

3. Stavropol Institute of Cooperation (Branch) Belgorod University of Cooperation, Economics & Law (SIC BUCEL), 355035, Russia, Stavropol, Goleneva Street, 36

4. Stavropol Institute of Cooperation (Branch) Belgorod University of Cooperation, Economics & Law (SIC BUCEL), 355035, Russia, Stavropol, Goleneva Street, 36

5. UMMC Technical University, 624091, Russia, Sverdlovsk region, Verkhnaya Pyshma, Uspenskiy Ave., 3